Right here’s a dialog between me and a hypothetical inventory market buyers who worries lots:

Investor: The S&P 500 is the one sport on the town to spend money on however I’m frightened as a result of the valuations are so excessive and the entire beneficial properties are coming from a handful of shares.

Me: For those who suppose the big cap U.S. shares are overvalued you would at all times spend money on small caps, worth shares or overseas shares.

Investor: Yeah however the returns for these shares have been horrible! They’ve all underperformed the S&P for years now!

Me: True however the valuations are far more affordable.

Investor: However the valuations are low for a purpose!

Me: Shares don’t get low-cost for no purpose!

It’s principally this meme:

I perceive the consternation.

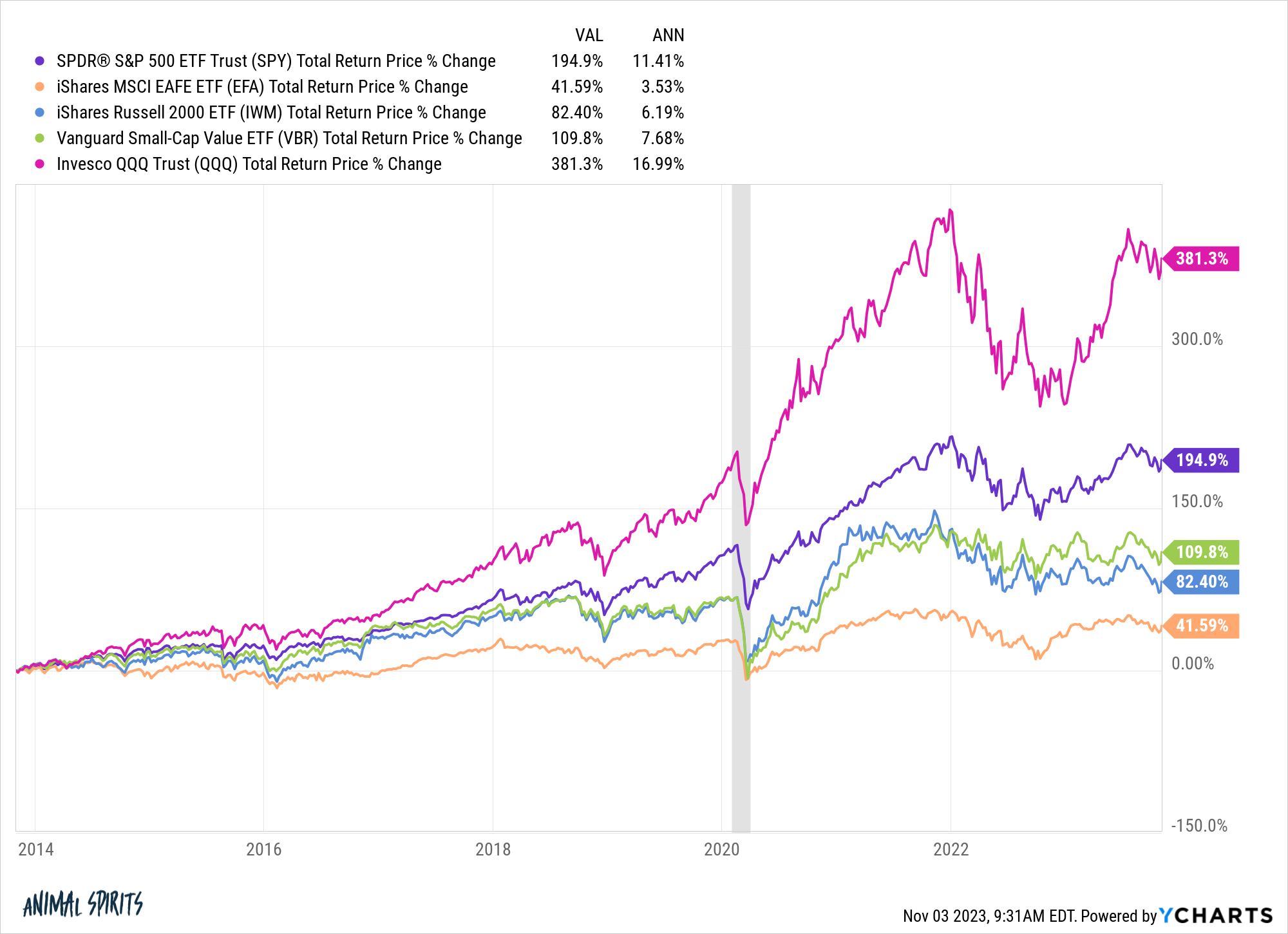

Huge tech shares have been carrying the day for a while now. Simply have a look at the distinction in efficiency between the tech-heavy Nasdaq 100 and S&P 500 versus the Russell 2000, small cap worth shares and worldwide equities over the previous 10 years:

Tech shares have been dominating and rightly so. These are a few of the most profitable companies the world has ever seen and the inventory costs bear this out.

It might be unprecedented if tech shares proceed to dominate the inventory market within the coming decade like they’ve over the earlier decade however unprecedented issues occur within the markets on a regular basis.

An AI bubble is actually not out of the query.

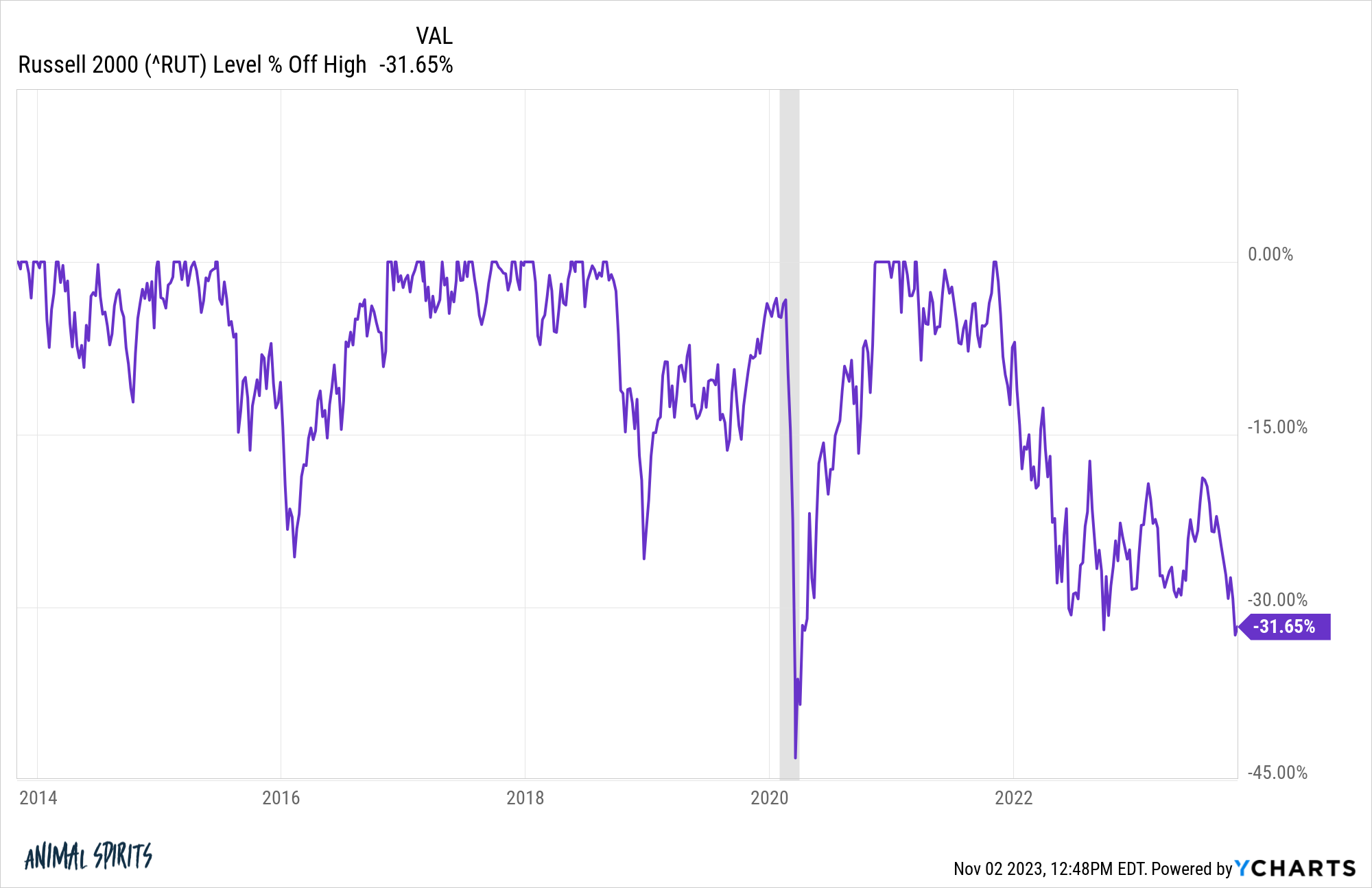

Small cap shares haven’t solely underperformed the S&P 500 however they’ve accomplished so with far larger volatility.

Take a look at the drawdown profile of the Russell 2000 over the previous ten years:

By my depend there have been give double-digit corrections prior to now ten years:

- 2014: -12.2%

- 2015-16: -26.4%

- 2018: -27.2%

- 2020: -41.9%

- 2022-23: -33.0%

That’s additionally 4 bear markets and two outright crashes of 30% or worse. This has not been a enjoyable time to carry small cap shares.

There’s a silver lining right here although.

This has been an impressive marketplace for greenback value averaging into small cap shares. Perhaps I’m a glutton for punishment, however I’ve been shopping for small caps throughout each correction alongside the way in which.

Falling costs are a great factor for periodic buyers.

For those who’re a web saver, you don’t need to see all-time highs on a regular basis. It’s best to hope for volatility, corrections and crashes. They permit you to purchase in at decrease costs and valuations.

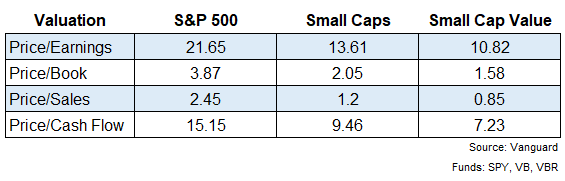

And valuations in small cap shares are very low proper now, relative to each the S&P 500 and their very own historical past.

I grabbed a handful of valuation metrics on the S&P 500 together with a easy Vanguard small cap index fund and small cap worth fund:

Throughout each metric small caps and worth shares look manner cheaper than giant caps.

To be truthful, small cap shares are low-cost for good purpose. Smaller companies are way more rate of interest delicate than giant companies. The largest corporations had been in a position to lock in extremely low rates of interest through the pandemic. Many small corporations weren’t so fortunate and are paying the worth now in a better fee surroundings.

Shares often underperform for good purpose.

There are sector variations as nicely which may assist clarify the valuation gaps. Tech shares make up one thing like 38% of the S&P 500 however simply 18% of the Vanguard small cap index fund.1

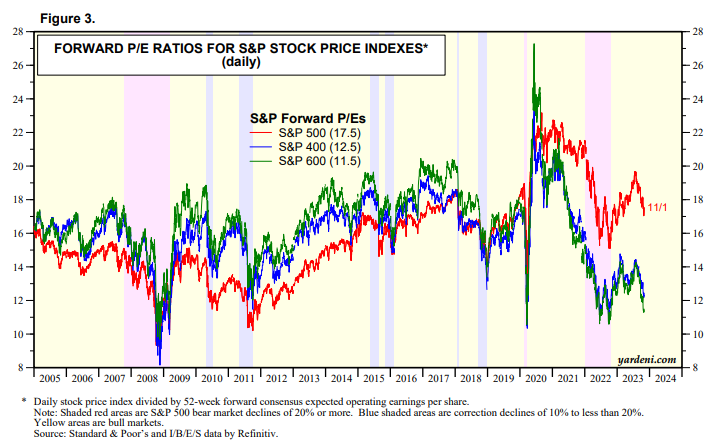

However even small cap shares relative to their very own historical past reveals valuations are moderately engaging. Right here’s a have a look at valuations for big caps, mid caps and small caps from Yardeni Analysis:

Small cap and mid cap shares are almost as low-cost as they had been on a ahead P/E foundation as they had been through the Covid crash. They’re cheaper now than they had been at any level through the 2010s.

After all, valuations don’t assure buyers something, particularly within the brief run. The S&P 500 has been costly relative to small caps, worldwide shares and worth shares for quite a few years now and it hasn’t mattered.

Perhaps fundamentals don’t matter anymore however that’s not a wager I’m keen to make with my financial savings.

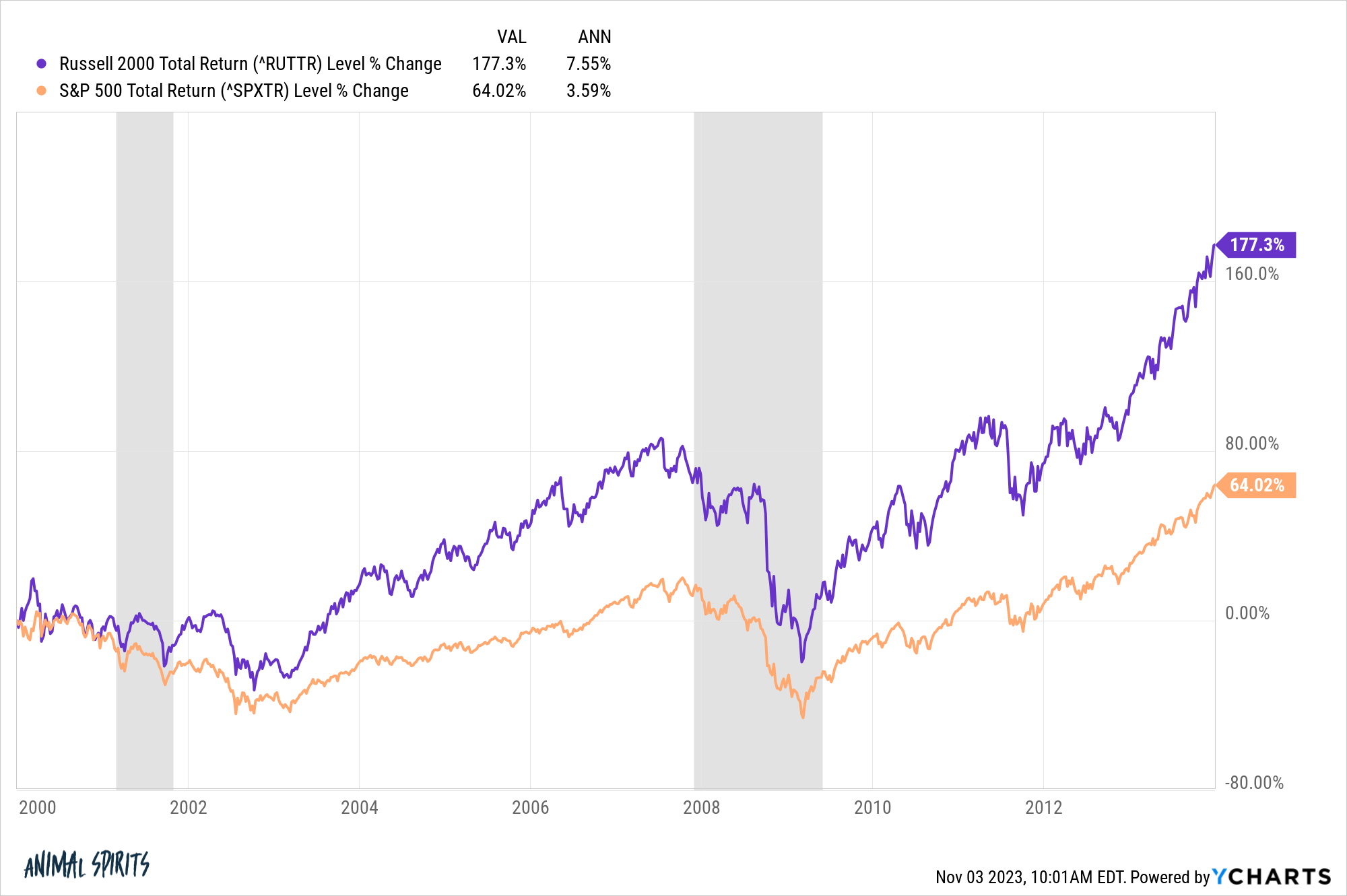

Plus, you don’t have to return all that far to discover a cycle the place the roles had been reversed and small caps dominated giant caps.

These are the returns from the beginning of 2000 by the tip of 2013:

Small cap shares destroyed the S&P 500 for nicely over a decade, greater than doubling up the returns of huge cap shares.

I’ve by no means been an all-or-nothing investor.

I don’t see the necessity to take pointless dangers by concentrating in any single sector or technique. There aren’t any free lunches on the subject of investing however diversification is about as low-cost as a sizzling canine and fountain drink at Costco.

Micheal and I talked concerning the inventory market going nowhere for 2 years and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Now right here’s what I’ve been studying currently:

Books:

1I’m together with each tech and communication companies in these calculations.