[ad_1]

Individuals have a tough time accepting competing concepts on the similar time.

People are averse to discomfort so when that occurs our brains work actually laborious to cut back that feeling. Cognitive dissonance makes it tough to see each side of an argument.

Every thing is both good or dangerous with no center floor.

And so it’s with the financial system.

Some folks suppose the present financial setting stinks. Different suppose individuals are overlooking the positives underlying the info.

As common, the reality in all probability lies someplace within the center.

To keep away from my very own cognitive dissonance, let’s have a look at each the great and the dangerous within the U.S. financial system proper now:

Financial progress is excessive. The U.S. financial system will not be getting sufficient credit score for swallowing probably the most aggressive Fed mountain climbing cycles in historical past and then printing actual GDP progress of just about 5%. Charges went from 0% to five% in a rush and the financial system continues to be booming.

You possibly can make the argument a variety of it is a normalization course of from the pandemic however within the face of rising charges it was definitely surprising contemplating most specialists assumed we’d already be in a recession by now.

This previous quarter was in all probability the height of progress this cycle and it’s attainable a recession is on the horizon however it might be laborious to argue we’re in a single proper now.

Financial progress is sweet.

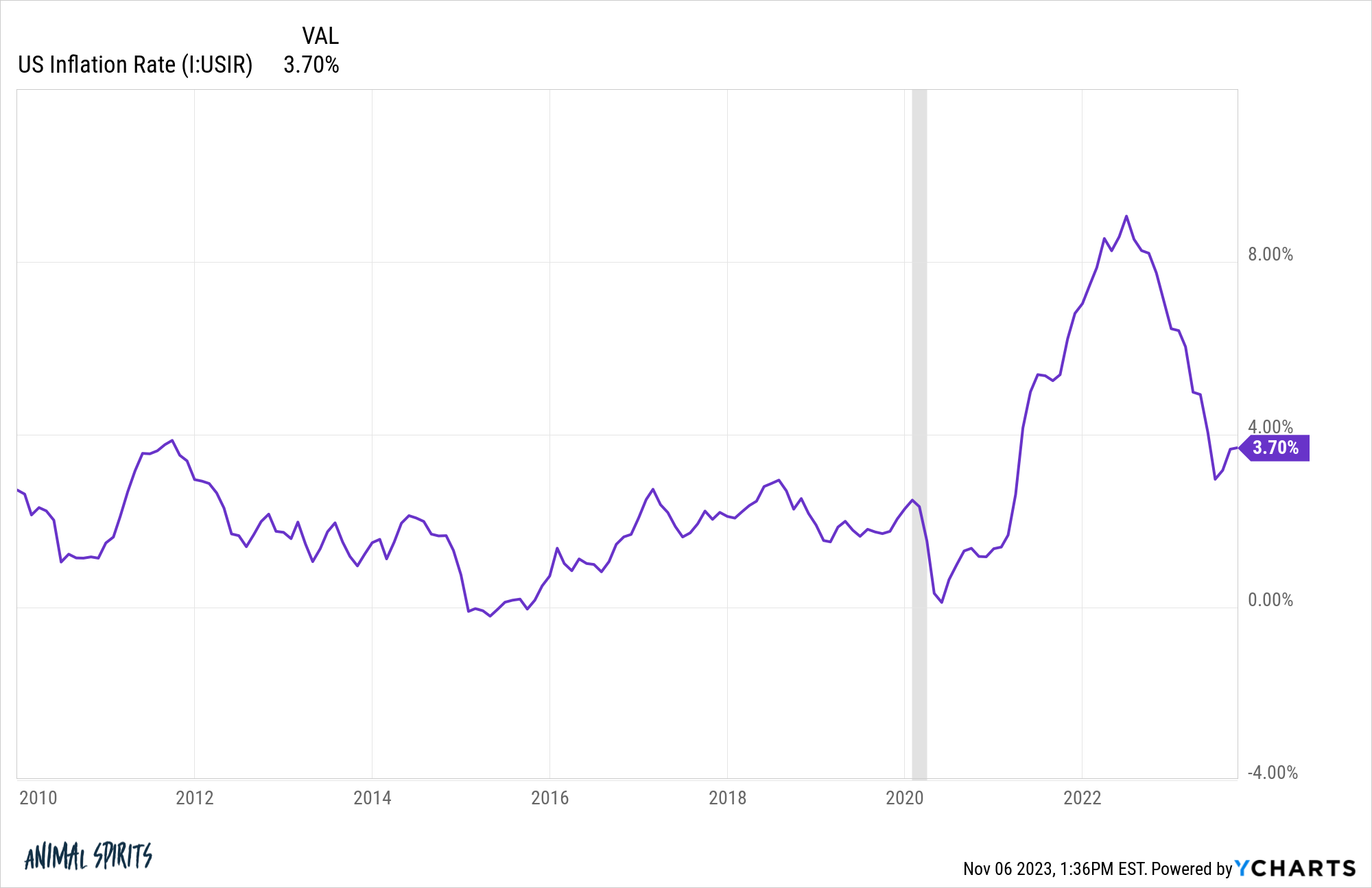

The inflation continues to be comparatively excessive. Shoppers actually hate inflation.

The inflation fee was solely this excessive as soon as in your complete decade of the 2010s which was briefly within the fall of 2011:

Lots of people didn’t just like the financial setting within the 2010s. Development was gradual. Wages have been stagnating. Rates of interest have been too low.

However folks hate excessive inflation far more than they disliked that setting.

Wages have roughly stored tempo with costs because the pandemic however folks get used to increased wages comparatively shortly. Greater costs beat you over the top each single day.

We’re on the proper path however the truth that inflation has skilled an uptick in latest months isn’t serving to with shopper sentiment.

Unstable costs should not good.

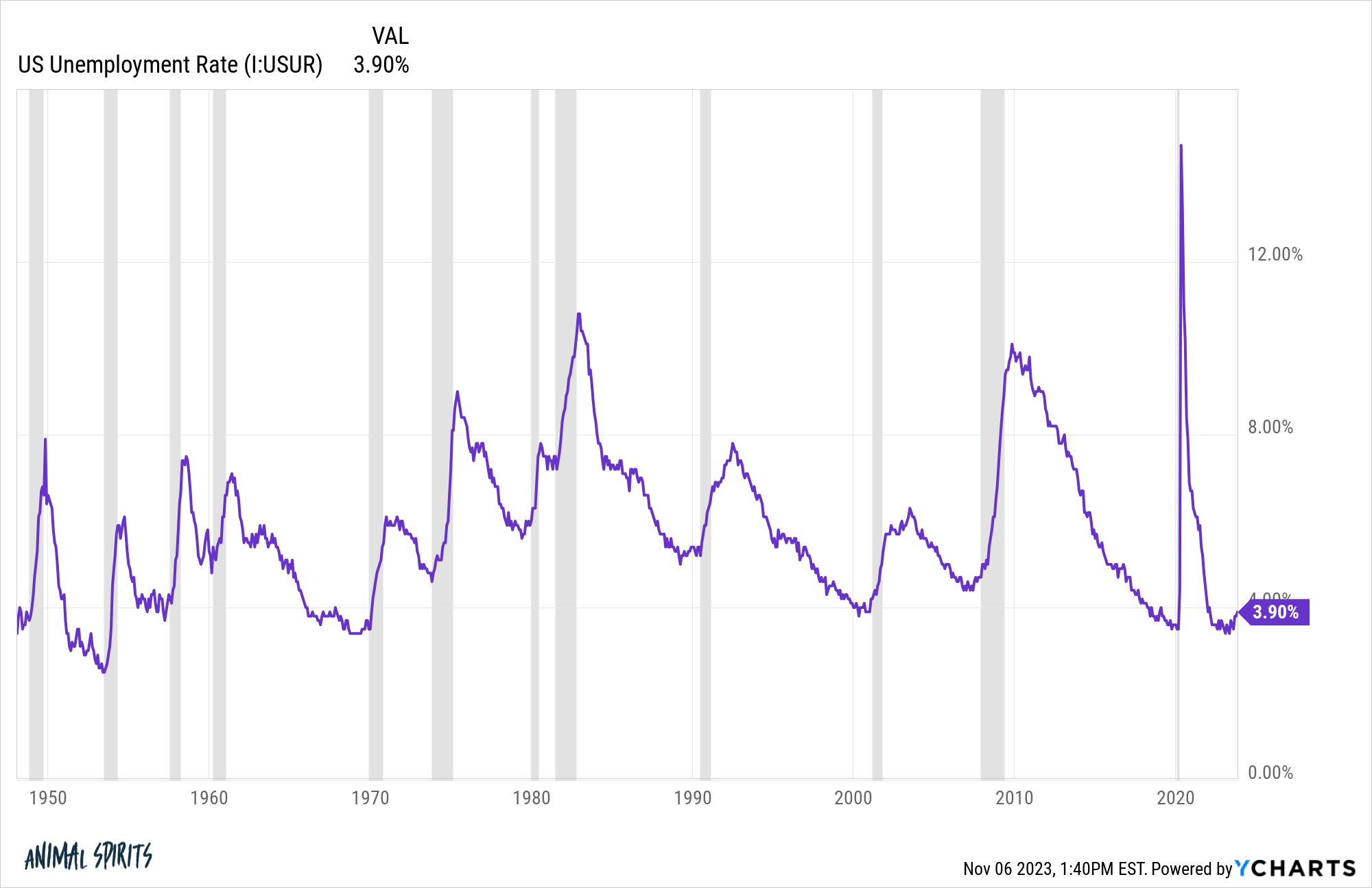

The unemployment fee is low. The unemployment fee by no means received as little as it’s in the present day even as soon as throughout the Nineteen Seventies, Nineteen Eighties or Nineties1:

The employment restoration from the pandemic was an financial miracle so far as I’m involved. Sure it value the federal government trillions of {dollars} however the various would have meant an financial system that fell trillions of {dollars} brief and tens of millions of individuals unemployed.

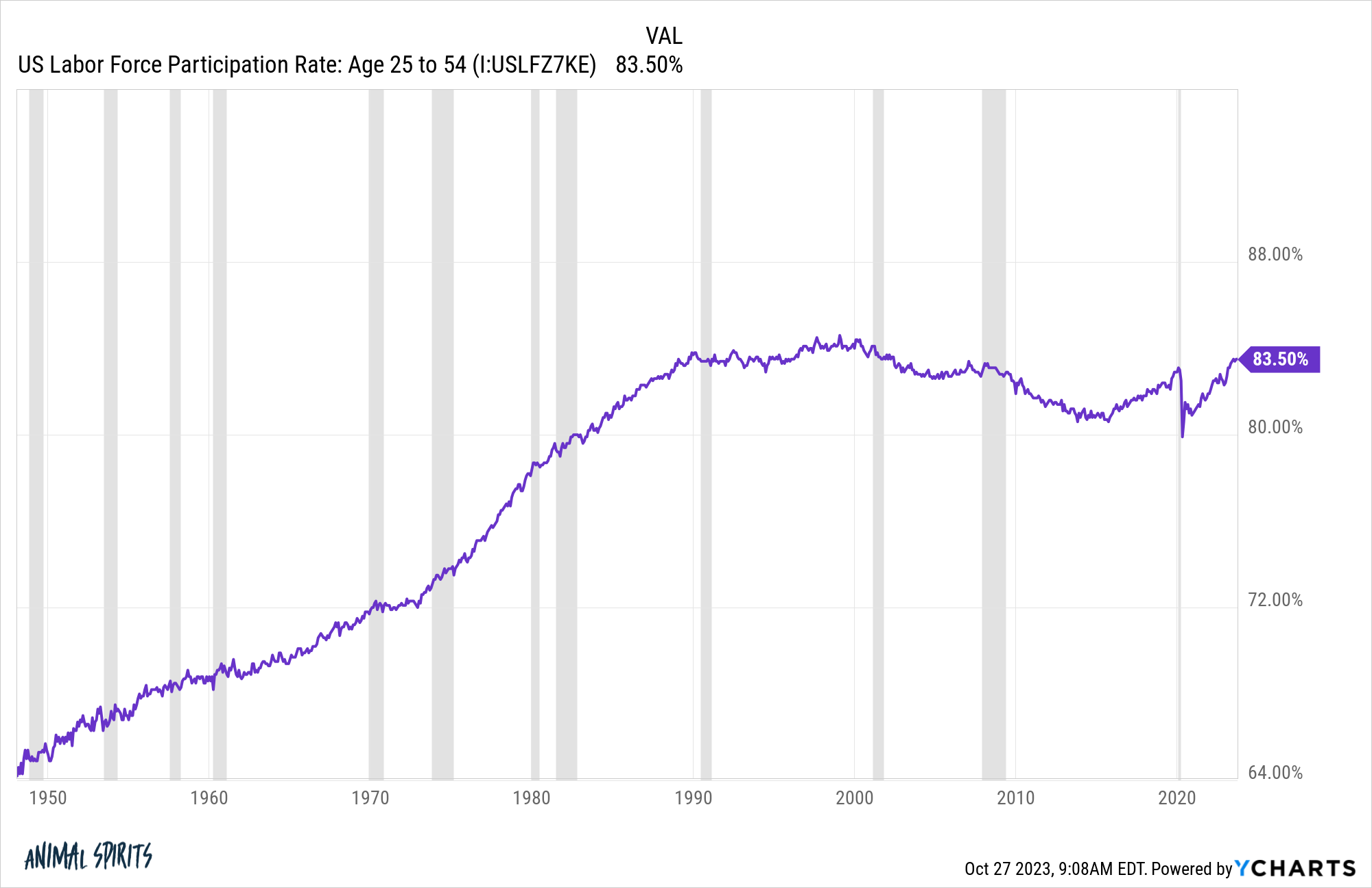

The general labor power participation ratio is usually a bit deceptive as a result of so many child boomers are retiring early however look the prime age (25-54) vary:

We’re inside spitting distance of the all-time highs within the Nineties and nicely above pre-pandemic ranges. Extra younger and middle-aged folks have really gotten jobs these previous three years.

Low unemployment is an efficient factor.

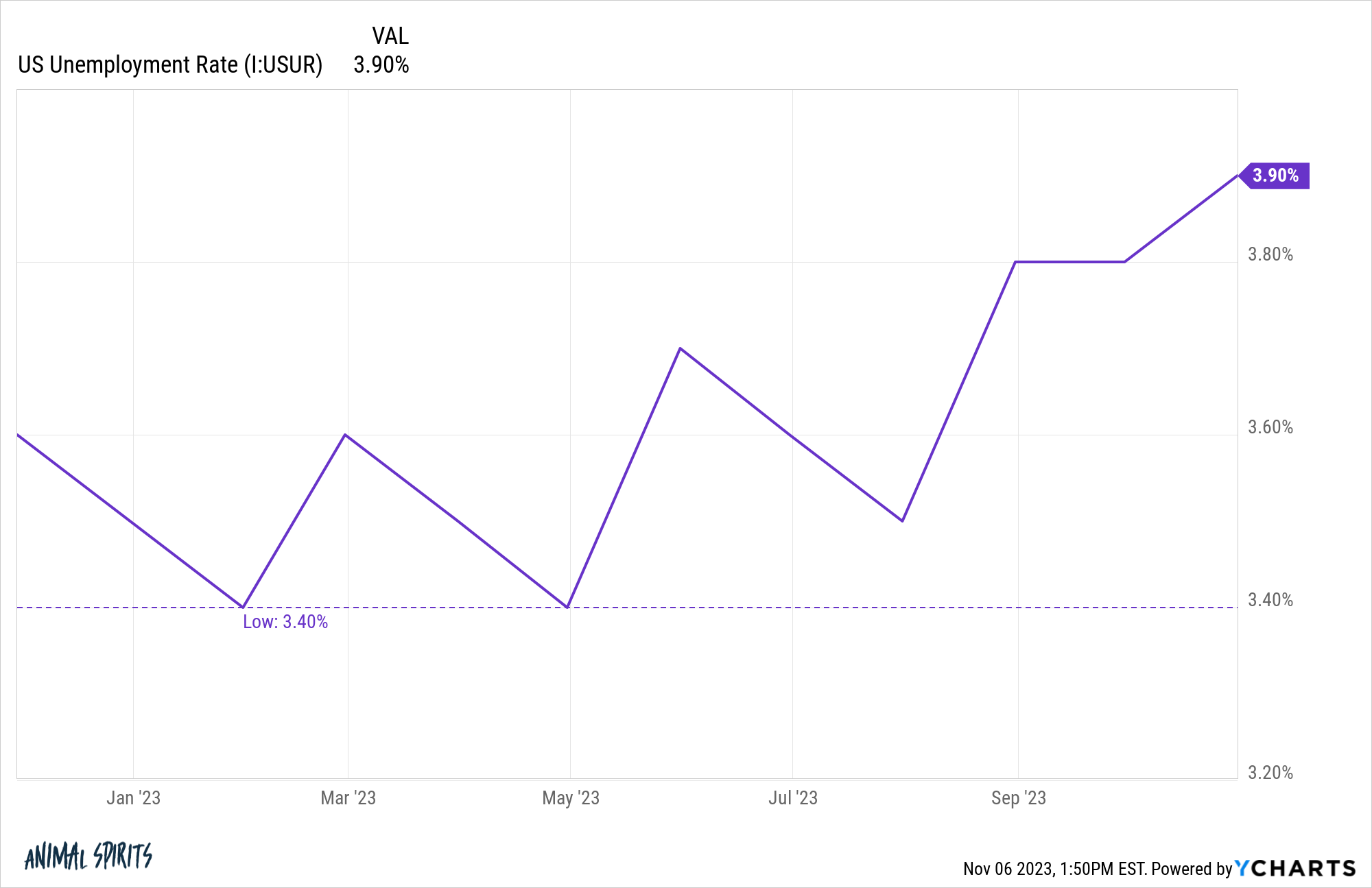

The unemployment fee is rising. The unemployment fee is traditionally low nevertheless it’s rising.

We’ve gone from a low of three.4% to three.9%:

Historic financial relationships have gotten thrown out the window this cycle however it might be uncommon to see a minor enhance within the unemployment fee with out a greater slowdown coming down the road.

Rising unemployment will not be good.

Rates of interest aren’t having an adversarial affect on customers but. Most customers and firms locked in ultra-low rates of interest throughout the pandemic.

Firms like Apple and Microsoft took out debt at generationally low ranges and are actually incomes excessive yields on their huge money balances. When you’re questioning why the inventory market has fared so nicely within the face of rising charges this it the best rationalization.

When you already owned a home or refinanced within the pre-2022 period, you’re not fretting about increased mortgage charges proper now until you need to transfer.

This is without doubt one of the major causes customers and firms alike have been so resilient all through this speedy rise in rates of interest.

Rate of interest-sensitive industries are feeling the ache. There are specific elements of the financial system the place increased charges are devastating their enterprise.

The Wall Avenue Journal lately ran a narrative in regards to the state of the mortgage lending enterprise and it’s ugly on the market:

Mortgage business employment has already declined 20% to about 337,000 folks, from 420,000 in 2021, based on Bureau of Labor Statistics knowledge compiled by the MBA, which anticipates an extra 10% decline. The employment tally contains mortgage bankers, brokers and mortgage processors however not real-estate brokers.

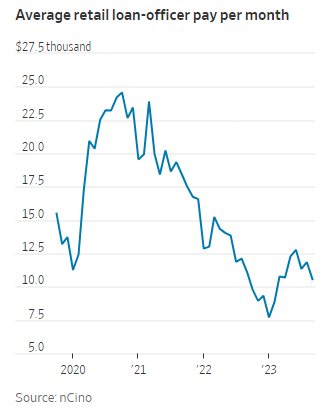

These nonetheless employed are incomes much less. Mortgage officers’ common month-to-month pay in September was down by greater than half from three years earlier, based on monetary expertise firm nCino. The typical mortgage officer closed 3.45 loans final month versus 8.15 in the identical month in 2020.

The mortgage market was Steve Walsh’s money cow, however now it’s squeezing him on each side. Enterprise at his Scottsdale, Ariz., mortgage brokerage, Scout Mortgage, is down about 90%, he stated, and head depend has fallen to seven from a excessive of about 25 on the finish of 2020.

Have a look at the typical month-to-month earnings rollercoaster:

Mortgage officers went from the roaring 20s to a melancholy within the span of three years.

I don’t see what makes this higher any time quickly since mortgage charges must fall precipitously to get exercise again to these ranges.

This business is in a world of ache.

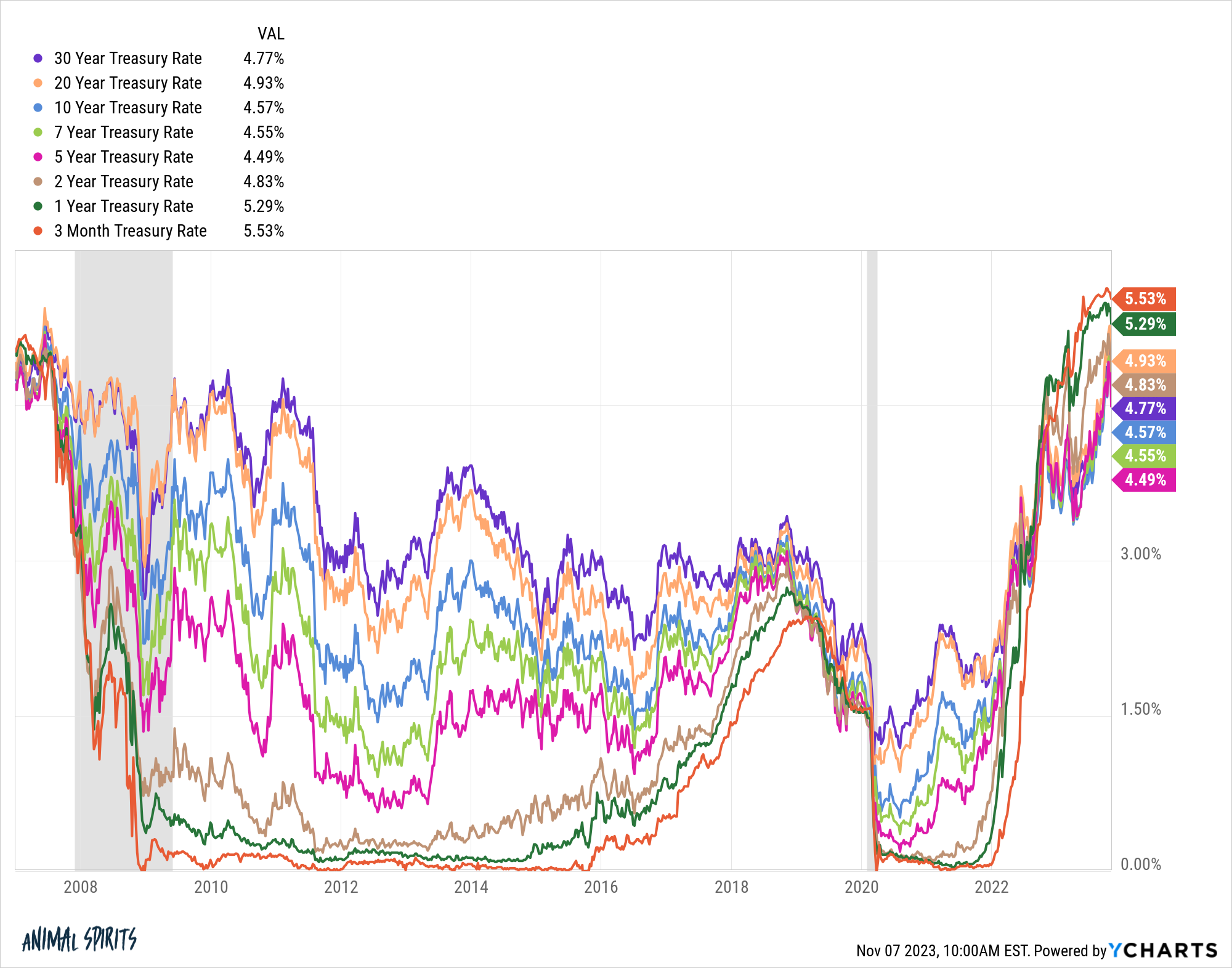

Savers are now not being punished. For the primary time in a decade-and-a-half, you’ll find first rate yields on CDs, cash market funds, on-line financial savings accounts and bonds.

Brief-term charges are the best they’ve been since 2007. Lengthy-term and intermediate-term yields have spike in latest months as nicely.

There are alternatives galore on your money or mounted earnings wants in the mean time.

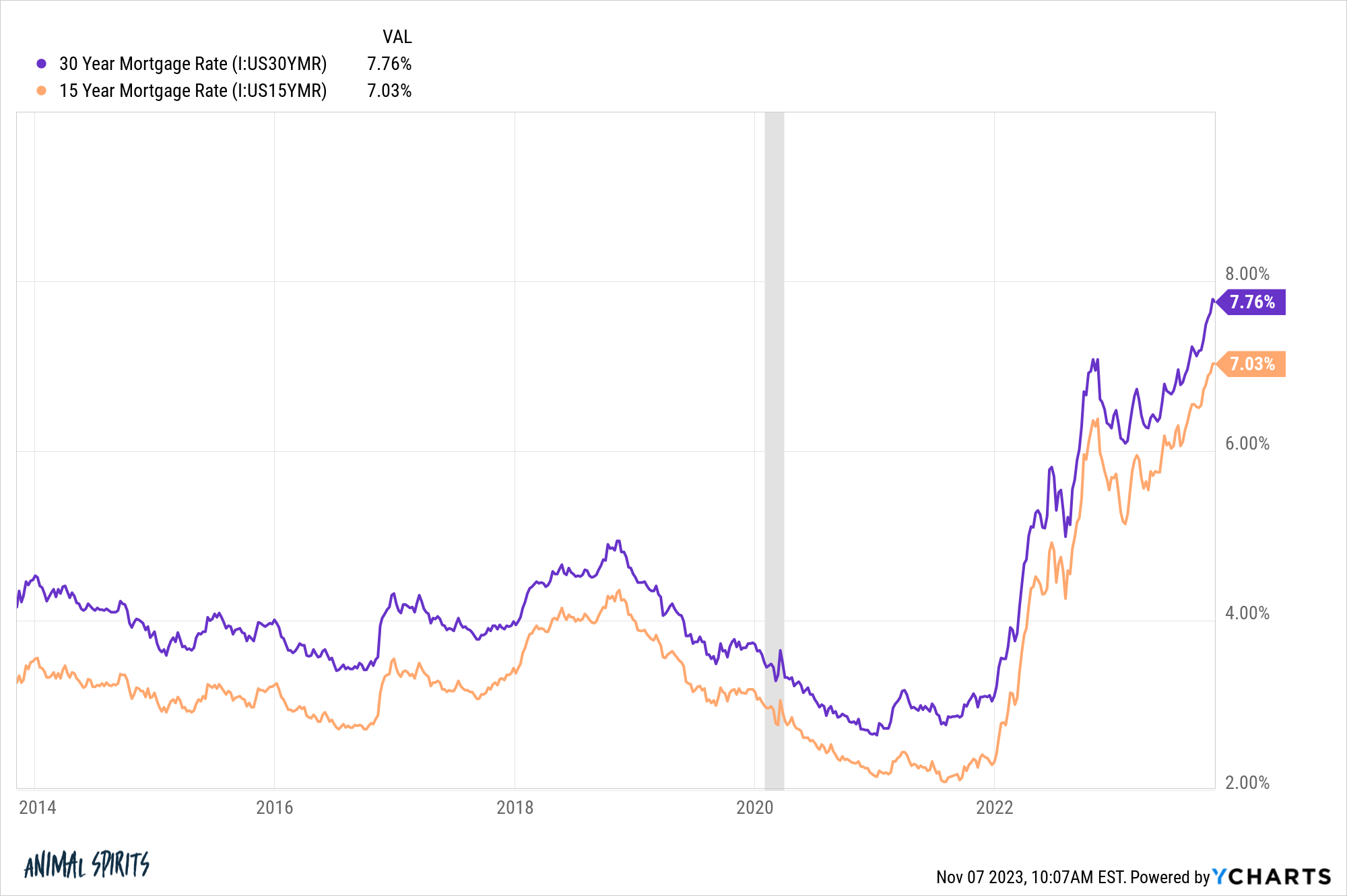

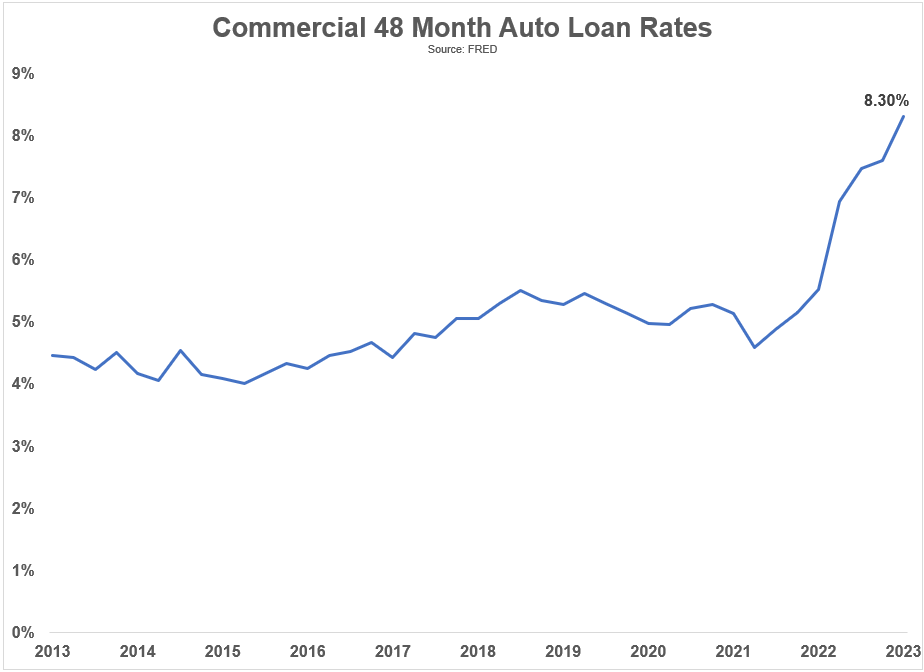

Debtors are being punished. When you locked in decrease charges, the present setting doesn’t appear so dangerous. However in the event you’re a borrower the phrases in the present day appear onerous when in comparison with the latest previous.

Mortgage charges are above 7%:

Automotive mortgage charges are actually nicely above 8%:

The mix of upper costs and better borrowing charges makes this a horrible setting for individuals who must tackle debt.

When you’re out there for a home or automotive, issues should not nice.

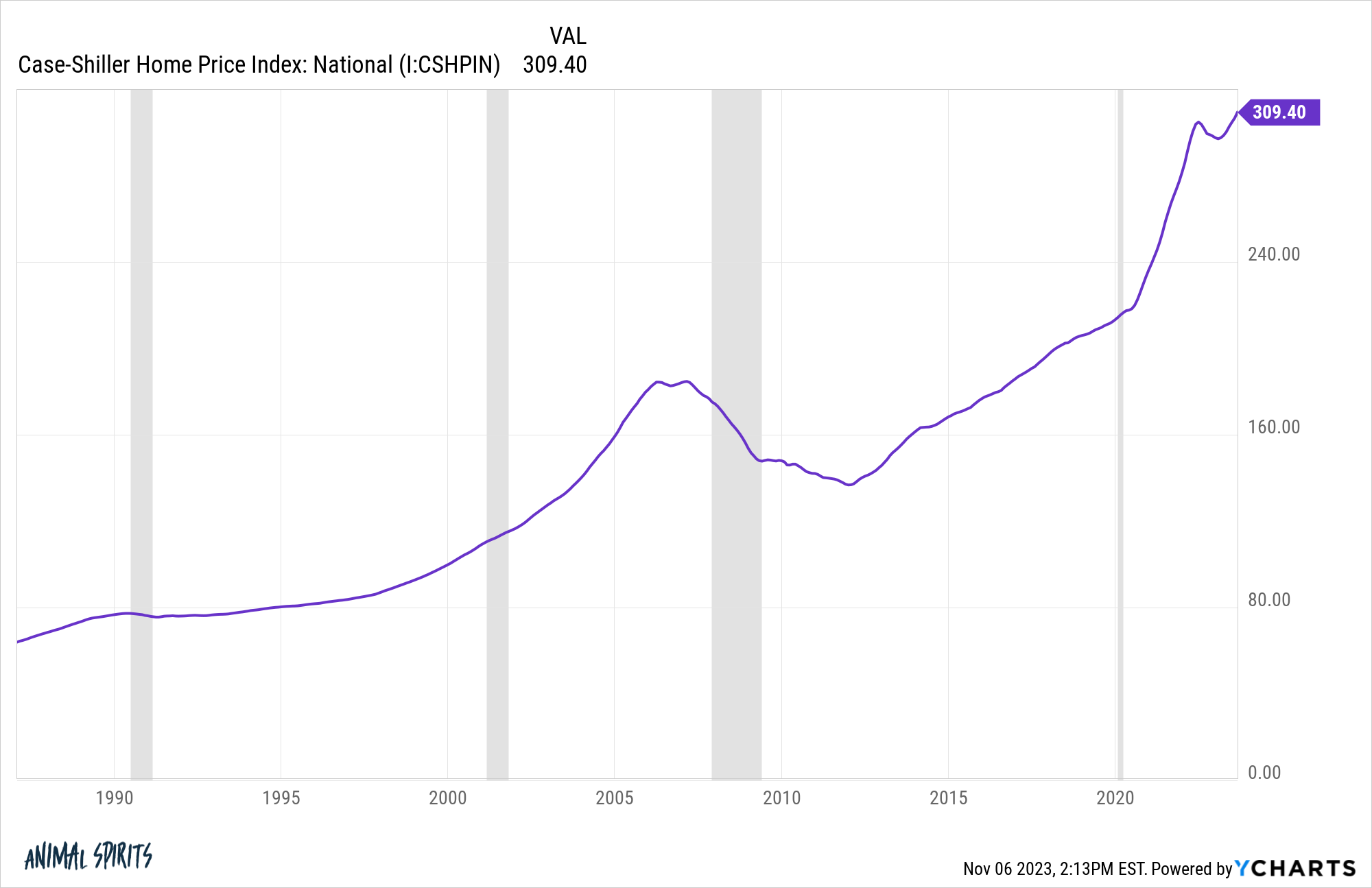

Housing costs are again at all-time highs. The Case-Shiller Nationwide Residence Worth Index is again at new all-time highs after a minor dip in costs:

You didn’t must go searching for some unique hedge in opposition to inflation. Proudly owning a house was your finest protection in opposition to an inflationary spike.

A lot of Individuals personal their properties so rising costs have been a boon to shopper stability sheets.

The housing market is damaged for anybody wanting to purchase. Excessive costs are useful to householders however good luck in the event you’re on the surface wanting in.

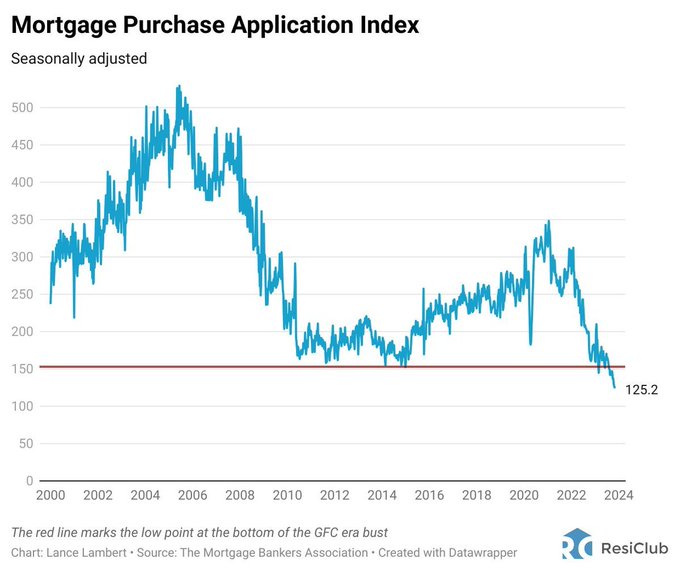

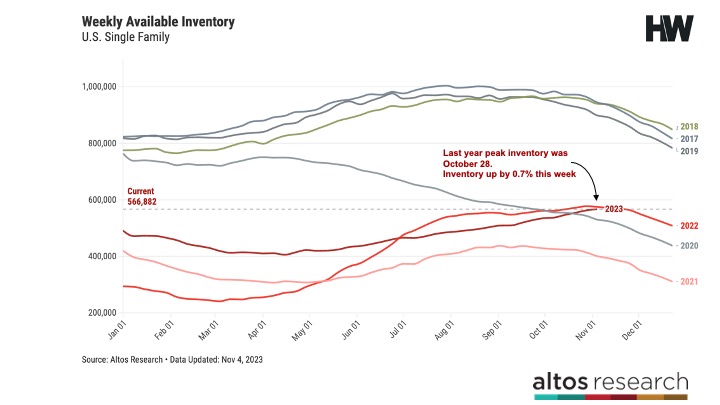

Provide is dreadful proper now. Simply have a look at mortgage buy purposes:

We’re nonetheless nicely beneath pre-pandemic ranges of housing provide:

Costs are up, it’s costly to borrow and there aren’t many homes available on the market.

That is only a dreadful time for anybody out there trying to purchase.

I may maintain going however you get the concept.

There are professionals and cons proper now for the U.S. financial system.

There’s an outdated saying: The place you stand is a perform of the place you sit. How you are feeling in regards to the U.S. financial system is dependent upon how your private financial system goes.

I care about aggregates, medians and averages when making an attempt to find out the pattern of the financial system however people and households don’t care about financial knowledge. All folks actually care about is their private scenario — their job, their private life, their funds, and many others.

There are good and dangerous issues occurring within the financial system proper now however all folks actually care about is the great and dangerous issues occurring in their very own lives.

Additional Studying:

The three Sorts of Inflation

1To be honest, the Nineties did finish with an unemployment fee of 4%. However we by no means noticed a sub-4% quantity in any of these three many years.

[ad_2]

Supply hyperlink