[ad_1]

As anticipation builds for the long-awaited approval of a spot Bitcoin ETF by the US Securities and Change Fee (SEC), an encouraging signal has emerged, additional rising the probability of approval.

The SEC issued an investor alert concerning “crypto asset securities,” prompting hypothesis that the spot Bitcoin ETF could also be nearer than ever.

Spot Bitcoin ETF Approval On The Horizon?

The current investor alert issued by the SEC has garnered important consideration within the cryptocurrency group. Whereas the alert doesn’t explicitly point out the spot Bitcoin ETF, many market contributors consider it’s a optimistic indicator for its potential approval.

The parallel between the investor alert and the approval of Bitcoin Futures provides to the rising optimism surrounding the spot Bitcoin ETF. Earlier than approving Bitcoin Futures, the SEC issued related alerts and warnings, indicating their concern and engagement with the underlying asset class.

Consequently, market observers, together with Bloomberg’s ETF knowledgeable Erich Balchunas, are deciphering the investor alert on “crypto asset securities” as a possible precursor to the approval of a spot Bitcoin ETF. Balchunas said:

Oh snap, SEC tweeting out academic supplies, warnings on crypto investing, which is one thing in addition they did forward of $BITO

It is very important notice that the SEC will consider numerous elements, together with investor safety, market integrity, and compliance with present laws, earlier than making a remaining willpower on the spot Bitcoin ETF.

Nonetheless, given the elevated consideration and progress in cryptocurrency, the issuance of the investor alert signifies a step in the proper path.

Potential BTC Surge To $48,000

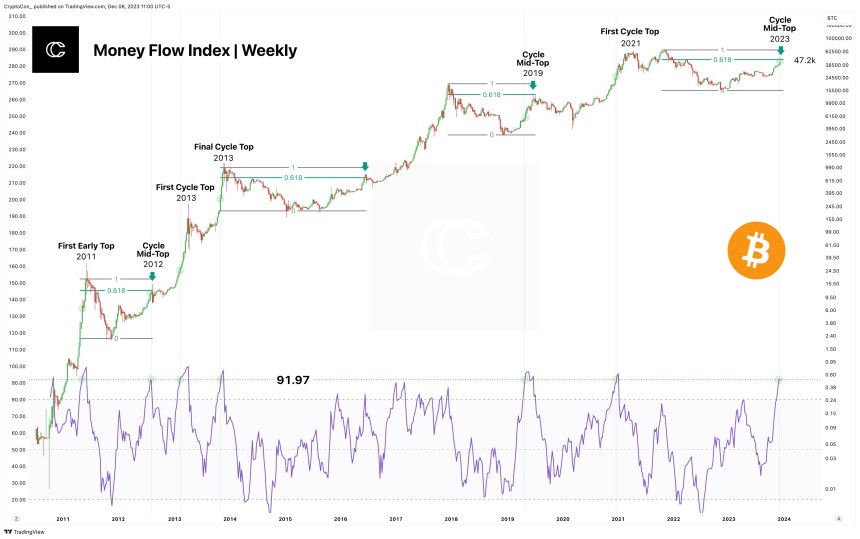

Famend crypto analyst, Crypto Con, has made fascinating observations concerning BTC’s present market dynamics that make clear the potential subsequent steps for the biggest cryptocurrency available on the market.

In response to Crypto Con, cash has been pouring into BTC at a fee not witnessed because the final cycle’s peak, with historic information indicating related patterns on solely 5 prior events.

This inflow of funds has heightened the market’s sentiment and created anticipation for potential additional value positive factors. Crypto Con highlights the importance of Bitcoin’s Cash Circulation Index (MFI), a technical indicator used to measure the energy and quantity of funds flowing into or out of an asset, which reached a worth of 91.57, traditionally indicating the presence of further bullish momentum.

Moreover, the analyst identifies the .618 cycle retrace of weekly candle our bodies as a focal point for potential goal ranges. This degree aligns with different important value areas, additional bolstering its significance.

Crypto Con means that Bitcoin’s value might probably attain the vary of $47,000-$48,000 primarily based on these goal ranges. Nonetheless, the analyst additionally notes that important value will increase are sometimes adopted by retracements at this stage out there cycle.

Crypto Con highlights the potential for a retracement after the completion of the present value rise. The analyst identifies the $31,000-$32,000 vary as an space of curiosity for a possible retracement primarily based on long-term information.

As of the time of writing, Bitcoin (BTC) is being traded at $43,800, showcasing a noteworthy restoration throughout the previous 24 hours following a retracement under $42,900 on Thursday.

Whereas this value rebound is encouraging, it stays unsure whether or not the prevailing market dynamics possess ample energy to propel Bitcoin past its present yearly excessive of $44,500. There’s a chance that Bitcoin could expertise one other failed try and surpass this degree, which might subsequently lead to a deeper retracement earlier than witnessing one other upward motion.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Supply hyperlink