[ad_1]

EUR/USD: Continuation of the Charge Struggle

● The labour market and inflation: these are the components that Central Banks carefully monitor when making selections relating to financial coverage and rates of interest. It’s enough to recall the numerous shift that occurred after the publication of October’s inflation information in the USA. In November, the greenback weakened considerably, and the classical portfolio of shares and bonds yielded the best revenue in 30 years! EUR/USD, beginning at 1.0516, reached a month-to-month peak on November 29 at 1.1016.

● Concerning the labour market, essential indicators have been launched on Friday, December 8, together with the unemployment charge and the variety of new non-farm payrolls (NFP) in the USA. The primary indicator revealed a decline in unemployment: in November, the speed dropped to three.7%, surpassing each the forecast and the earlier worth of three.9%. The second indicator confirmed a rise within the variety of new jobs: 199K have been created in a month, surpassing each the October determine of 150K and the market expectations of 180K. It can’t be mentioned that such statistics considerably supported the greenback. Nonetheless, on the very least, it didn’t hurt it.

● Two to a few months in the past, the market’s response to such information would have been extra intense, as there have been nonetheless hopes for additional will increase within the Federal Reserve’s rates of interest in 2023. Now, these expectations are almost decreased to zero. The discussions revolve not round how the important thing charge will rise, however fairly how lengthy it will likely be maintained on the present degree of 5.50% and the way actively the regulator will scale back it.

An economist survey performed by Reuters revealed that simply over half of the respondents (52 out of 102) consider that the speed will stay unchanged at the least till July. The remaining 50 respondents count on the Federal Reserve to begin slicing earlier than that. 72 out of 100 respondents consider that by 2024, the speed will progressively be decreased by a most of 100 foundation factors (bps), probably even much less. Solely 5 specialists nonetheless maintain hope for additional charge will increase, even when it is simply by 25 bps. It is value noting that Reuters’ survey outcomes don’t align with the quick market expectations, which forecast 5 charge cuts of 25 bps every ranging from March.

● A Citi economist, as a part of the Reuters survey, famous that a rise in core inflation would disrupt the narrative of the Federal Reserve reducing rates of interest and delay this course of. The upcoming inflation information in the USA can be obtainable on Tuesday, December 12, and Wednesday, December 13, with the discharge of the November Client Value Index (CPI) and Producer Value Index (PPI), respectively. Following this, on Wednesday, we will count on the Federal Open Market Committee (FOMC) assembly of the U.S. Federal Reserve, the place selections on rates of interest can be made. Market members will undoubtedly give attention to the financial forecasts offered by the FOMC and the feedback from the management of the Federal Reserve.

● Nonetheless, it isn’t solely the Federal Reserve that influences the EUR/USD pair; the European Central Financial institution (ECB) additionally performs a major function, and its assembly is scheduled for subsequent week on Thursday, December 14. At the moment, the bottom charge for the euro stands at 4.50%. Many market members consider it’s too excessive and will push the delicate financial system of the area into recession.

Deflation within the Eurozone is significantly outpacing that in the USA. Final week, Eurostat reported that, in accordance with preliminary information, the Harmonized Index of Client Costs (HICP) fell to its lowest degree since June 2021, at 2.4% (y/y), which is decrease than each October’s 2.9% and the anticipated 2.7%. That is very near the goal degree of two.0%. Therefore, to assist the financial system, the ECB might quickly provoke the method of easing its financial coverage.

Market forecasts recommend that the primary reduce in the important thing charge may happen in April, with a 50% likelihood even a month earlier in March. There’s a 70% likelihood that by 2024, the speed can be decreased by 125 bps. Nonetheless, the consensus estimate amongst Reuters specialists is extra conservative, anticipating a lower of solely 100 bps.

● So, the speed conflict between the Federal Reserve and the European Central Financial institution will proceed. Whereas the one who beforehand prevailed was the one with sooner advancing charges, now the benefit can be with the one whose retreat happens extra slowly. It’s totally potential that buyers will obtain some info relating to the regulators’ plans after their conferences subsequent week.

● As for the previous week, EUR/USD concluded on the degree of 1.0760. At the moment, professional opinions relating to the pair’s quick future are divided as follows: 75% voted for the strengthening of the greenback, whereas 25% sided with the euro. Amongst pattern indicators on D1, the distribution is identical as with specialists: 75% for the greenback and 25% for the euro. For oscillators, 75% favor the purple facet (with 1 / 4 of them within the overbought zone), whereas 10% level in the other way, and 15% stay impartial.

The closest assist for the pair is located round 1.0725-1.0740, adopted by 1.0620-1.0640, 1.0500-1.0520, 1.0450, 1.0375, 1.0200-1.0255, 1.0130, and 1.0000. Bulls will encounter resistance round 1.0800-1.0820, 1.0865, 1.0965-1.0985, 1.1020, 1.1070-1.1110, 1.1150, 1.1230-1.1275, 1.1350, and 1.1475.

● Along with the occasions talked about earlier, the financial calendar highlights the discharge of the abstract information on the U.S. retail market on Thursday, December 14th. On the identical day, the variety of preliminary claims for unemployment advantages can be historically printed, and on December fifteenth, the preliminary values of the Buying Managers’ Index (PMI) within the manufacturing and providers sectors of the USA can be launched. Moreover, on Friday, preliminary information on enterprise exercise in Germany and the Eurozone as an entire can be disclosed.

GBP/USD: Ought to We Count on a Shock from the BoE?

● The Financial institution of England (BoE) performed its quarterly survey on December 8. It seems that inflation expectations for the UK inhabitants in November 2024 are 3.3%, which is decrease than the earlier quarter’s determine of three.6%. In the meantime, 35% of the nation’s inhabitants believes that they might personally profit from a lower in rates of interest. In different phrases, the bulk (65%) just isn’t involved about this indicator. Nonetheless, it’s a matter of concern for market members.

The BoE assembly may also happen subsequent week, on Thursday, December 14, shortly earlier than the ECB assembly. What would be the determination on the rate of interest? Recently, the hawkish rhetoric of the Financial institution of England’s management has verbally supported the British forex. For example, BoE Governor Andrew Bailey just lately acknowledged that charges ought to rise for longer, even when it might negatively affect the financial system. Nonetheless, specialists predict that the regulator will possible preserve the established order on the upcoming assembly, retaining the important thing rate of interest at 5.25%, which is already the best degree within the final 15 years.

Expectations for the speed in 2024 suggest an 80 bps lower to 4.45%. If the Federal Reserve lowers its charge to 4.25%, it will give the pound some hope for strengthening. Nonetheless, this can be a matter of the comparatively distant future. Final week, the greenback actively recouped November losses, ensuing within the GBP/USD pair ending the five-day interval at 1.2548.

● Talking of its quick future, 30% voted for the pair’s rise, one other 30% for its fall, and 40% remained detached. Amongst pattern indicators on D1, 60% level north, whereas 40% level south. Amongst oscillators, solely 15% are bullish, 50% bearish, and the remaining 35% stay impartial. Within the occasion of the pair shifting south, it’ll encounter assist ranges and zones at 1.2500-1.2520, 1.2450, 1.2370, 1.2330, 1.2210, 1.2070-1.2085, and 1.2035. In case of an upward motion, the pair will face resistance at ranges 1.2575, then 1.2600-1.2625, 1.2695-1.2735, 1.2800-1.2820, 1.2940, 1.3000, and 1.3140.

● Among the many essential occasions within the upcoming week, along with the Financial institution of England assembly, the discharge of a complete set of information from the UK labour market is scheduled for Tuesday, December 12. Moreover, the nation’s GDP figures can be printed on Wednesday, December 13.

USD/JPY: Is the Financial institution of Japan Dropping Warning?

● The strengthening of the Japanese forex has taken on a sustained character for the reason that starting of November. This occurred a few weeks after the height in yields of U.S. ten-year Treasury bonds when the markets have been satisfied that their decline had turn out to be a pattern. It is value noting that there’s historically an inverse correlation between these securities and the yen. If Treasury yields rise, the yen weakens in opposition to the greenback. Conversely, if bond yields fall, the yen strengthens its positions.

A major second for the Japanese forex was on Thursday, December 7, when it strengthened throughout the market spectrum, gaining roughly 225 factors in opposition to the U.S. greenback and reaching a three-month peak. USD/JPY recorded its minimal at that second on the degree of 141.62.

● The principle purpose for the yen’s advance has been the rising expectations that the Financial institution of Japan (BoJ) will lastly abandon its unfavorable rate of interest coverage, and that is anticipated to occur prior to anticipated. Rumours recommend that regional banks within the nation are pressuring the regulator, advocating for a departure from the yield curve management coverage.

As if to verify these rumours, the BoJ performed a particular survey of market members to debate the results of abandoning the ultra-loose financial coverage and the negative effects of such a transfer. Moreover, the go to of the BoJ Governor, Kadsuo Ueda, to the workplace of Prime Minister Fumio Kishida, added gas to the hearth.

● The yen can also be benefiting from market confidence that the important thing rates of interest of the Federal Reserve (FRS) and the European Central Financial institution (ECB) have reached a plateau, and additional reductions are the one expectation. Because of such a divergence, an accelerated narrowing of yield spreads between Japanese authorities bonds on one facet and related securities from the US and Eurozone on the opposite will be predicted. That is anticipated to redirect capital flows into the yen.

Moreover, the Japanese forex might need been supported by the slowdown within the development of inventory markets over the previous three weeks. The yen is commonly used as a funding forex for buying dangerous belongings. Due to this fact, profit-taking on inventory indices corresponding to S&P500, Dow Jones, Nasdaq, and others has moreover pushed USD/JPY decrease.

● Graphical evaluation signifies that in October 2022 and November 2023, the pair shaped a double prime, reaching a peak at 151.9. Due to this fact, from this attitude, its retracement downward is kind of logical. Nonetheless, some specialists consider {that a} definitive reversal on the each day timeframe (D1) can solely be mentioned after it breaks by way of assist within the 142.50 zone. Nonetheless, on the time of scripting this evaluation, on the night of Friday, December eighth, because of sturdy US labor market information, USD/JPY rebounded from an area low, moved upward, and concluded at 144.93.

Within the quick future, 45% of specialists anticipate additional strengthening of the yen, 30% facet with the greenback, and 25% stay impartial. As for indicators on D1, the benefit is overwhelmingly in favour of the purple color. 85% of pattern indicators are colored purple, 75% of oscillators are within the purple, and solely 25% are within the inexperienced.

The closest assist degree is situated within the 143.75-144.05 zone, adopted by 141.60-142.20, 140.60, 138.75-139.05, 137.25-137.50, 135.90, 134.35, and 131.25. Resistances are positioned on the following ranges and zones: 145.30, 146.55-146.90, 147.65-147.85, 148.40, 149.20, 149.80-150.00, 150.80, 151.60, and 151.90-152.15.

● Apart from the discharge of the Tankan Giant Producers’ Index on December 13 for This autumn, there is no such thing as a anticipation of different important macroeconomic statistics relating to the state of the Japanese financial system.

CRYPTOCURRENCIES: Rational Development or Speculative Frenzy?

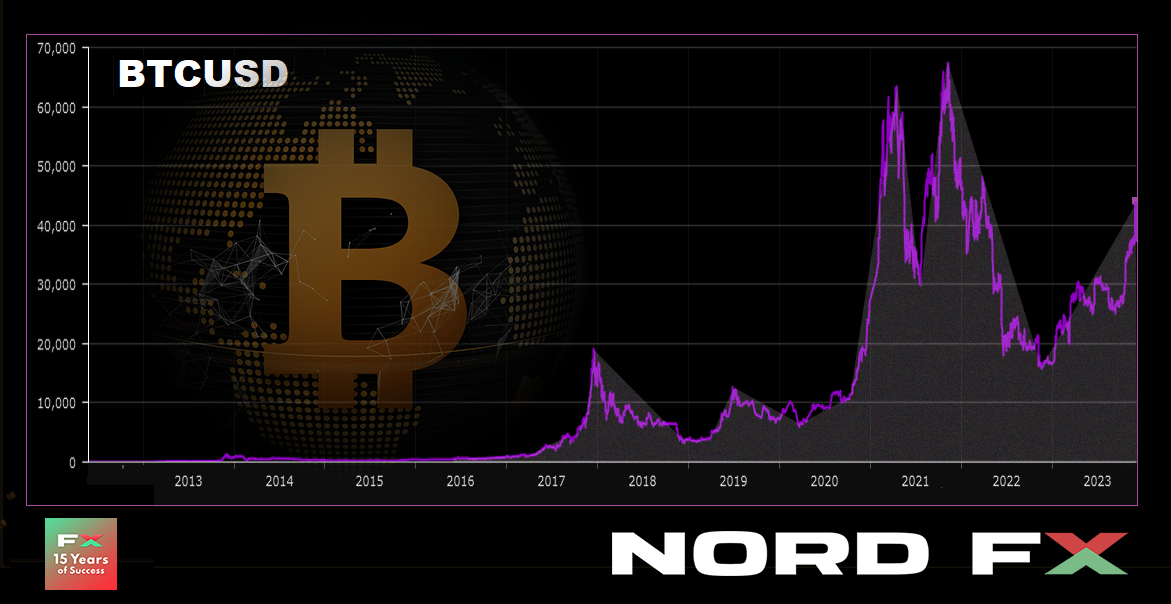

● Late within the night on December 8, the flagship cryptocurrency reached a peak of $44,694. The final time BTC traded above $40,000 was in April 2022, earlier than the Terra ecosystem crash triggered an enormous crypto market collapse. Among the many causes for the sharp rise in BTC, rising community hash charge, investor optimism in regards to the U.S. financial restoration, and expectations of a Federal Reserve coverage easing are talked about. Nonetheless, the principle purpose for the present bull rally is undoubtedly the potential approval of spot Bitcoin ETFs within the U.S.

Twelve firms have submitted purposes to the Securities and Change Fee (SEC) to create ETFs, collectively managing over $20 trillion in belongings. For comparability, all the market capitalization of bitcoin is $0.85 trillion. These firms won’t solely supply present shoppers the chance to diversify their belongings by way of cryptocurrency investments but in addition entice new buyers, considerably boosting BTC capitalization. Franklin Templeton CEO Jenny Johnson, overseeing $1.4 trillion in belongings, just lately defined the elevated institutional curiosity, stating, “The demand for bitcoin is clear, and a spot ETF is the easiest way to entry it.” Bloomberg analyst James Seyffart believes that the approval of those fund launches is 90% more likely to happen from January 5 to 10.

● In keeping with Bitfinex specialists, the present lively provide of bitcoin has dropped to a five-year low: solely 30% of the cash have moved previously 12 months. Consequently, roughly 70% of bitcoins, or “unprecedented” 16.3 million BTC, remained dormant over the 12 months. On the identical time, 60% of the cash have been in chilly wallets for 2 years. Concurrently, as famous by Glassnode, the common deposit quantity on cryptocurrency exchanges has approached absolute highs, reaching $29,000. Contemplating that the variety of transactions is constantly lowering, this means the dominance of enormous buyers.

Alongside the bitcoin rally, inventory costs of associated firms have additionally surged. Specifically, shares of Coinbase, MicroStrategy, miners Riot Platforms, Marathon Digital, and others have seen a rise.

● Senior Macro Strategist at Bloomberg Intelligence, Mike McGlone, believes that bitcoin is at present demonstrating a lot larger power than gold. He famous that on December 4, the value of gold reached a report excessive, after which it decreased by 5.1%, whereas bitcoin continued to rise, surpassing $44,000. Nonetheless, the analyst warned that bitcoin’s volatility may hinder it from being traded as reliably as bodily gold throughout “risk-off” durations. In keeping with McGlone, for bitcoin to compete with treasured metals instead asset, it should set up key reliability indicators. This features a unfavorable correlation of BTC with the inventory market and reaching a excessive deficit during times of financial enlargement.

● McGlone’s warning pales compared to the forecast of Peter Schiff, President of the brokerage agency Euro Pacific Capital. This well-known crypto sceptic and advocate for bodily gold is assured that the speculative frenzy round BTC-ETF will quickly come to an finish. “This may very well be the swan track… The collapse of Bitcoin can be extra spectacular than its rally,” he warns buyers.

Former SEC official John Reed Stark echoes his sentiments. “Cryptocurrency costs are rising for 2 causes,” he explains. “First, as a result of regulatory gaps and potential market manipulation; second, as a result of the potential for promoting inflated, overvalued cryptocurrency to a fair greater idiot […] This additionally applies to hypothesis a couple of 90% likelihood of approving spot ETFs.”

● Within the curiosity of equity, it ought to be famous that the present surge just isn’t solely the fault of spot BTC-ETFs. The thrill round them progressively began build up since late June when the primary purposes have been submitted to the SEC. Bitcoin, alternatively, started its upward motion from early January, rising greater than 2.6 occasions throughout this era.

A number of specialists level out that the present state of affairs remarkably mirrors earlier BTC/USD cycles. At the moment, the drawdown from the all-time excessive (ATH) is 37%, within the earlier cycle for a similar elapsed time, it was 39%, and within the 2013-17 cycle, it was 42%. If we measure from native bottoms as a substitute of peaks, an analogous sample emerges. (The primary rallies are an exception, as younger Bitcoin grew considerably sooner within the nascent market.)

● In keeping with Blockstream CEO Adam Again, the value of bitcoin will surpass the $100,000 degree even earlier than the upcoming halving in April 2024. The trade veteran famous that his forecast would not consider a possible bullish impulse within the occasion of SEC approval of spot bitcoin ETFs. Concerning the long-term motion of digital gold quotes, the entrepreneur agreed with the opinion of BitMEX co-founder Arthur Hayes, forecasting a spread of $750,000 to $1 million by 2026.

For reference: Adam Again is a British businessman, a cryptography professional, and a cypherpunk. It’s identified that Again corresponded with Satoshi Nakamoto, and a reference to his publication is included within the description of the bitcoin system. Beforehand, Adam Again didn’t make public worth forecasts for BTC, so many members of the crypto group paid shut consideration to his phrases.

● The CEO of Ledger, Pascal Gauthier, the pinnacle of Lightspark, David Marcus, and the highest supervisor of the CoinDCX trade, Vijay Ayyar, additionally anticipate the bitcoin trade charge to achieve $100,000 in 2024. They shared this info in an interview with CNBC. “Evidently 2023 was a 12 months of preparation for the upcoming development. Sentiments relating to 2024 and 2025 are very encouraging,” mentioned Pascal Gauthier. “Some market members count on a bullish pattern someday after the halving, however contemplating the information about ETFs, we may very properly begin the rise earlier than that,” believes Vijay Ayyar. Nonetheless, not like Adam Again, in his opinion, “an entire rejection of ETFs may disrupt this course of.”

● Famend bitcoin maximalist, tv host, and former dealer Max Keiser shared unconfirmed rumors that the sovereign wealth fund of Qatar is getting ready to enter the crypto market with huge investments and plans to allocate as much as $500 billion within the main cryptocurrency. “This can be a seismic shift within the cryptocurrency panorama, permitting bitcoin to probably surpass the $150,000 mark within the close to future and go even additional,” acknowledged Keiser.

● In contrast to the tv host, we’ll share not rumors however completely correct info. The primary truth is that as of the evaluation writing on the night of December 8, BTC/USD is buying and selling round $44,545. The second truth is that the whole market capitalization of the crypto market is $1.64 trillion ($1.45 trillion per week in the past). And at last, the third truth: the Crypto Concern and Greed Index has risen from 71 to 72 factors and continues to be within the Greed zone.

NordFX Analytical Group

Discover: These supplies usually are not funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]

Supply hyperlink