[ad_1]

Indices Time Breakout EA Model 1

This doc serves as a handbook for the EA https://www.mql5.com/en/market/product/109726 and can be up to date as and when required.

IMPORTANT NOTE:

Please DO NOT use the default settings within the EA, these settings will not be designed for use for actual buying and selling. EAs listed on the MQL5 market must endure strict testing standards on a number of devices and timeframes and whereas that is good for testing the logic and code of an EA this hinders having the ability to record EAs which might be designed to work on particular devices and timeframes like this one. So the default settings are designed to get the EA to go these exams on hourly and every day timeframes which it isn’t designed to run on however has to go validation for. 🙂

The EA is designed to be run on the totally different timeframes on the key inventory indices.

WHAT’S IN THIS BLOG POST:

1. Transient Description of the Technique

2. An in depth record of all of the inputs and what they do in addition to how they have an effect on buying and selling.

HOW TO USE Indices Time BreakOut EA:

The EA ought to be positioned on the M5,M15,M30 but in addition totally different Time Frames on any inventory index such because the DAX, NASDAQ, DOW, S&P500 and many others….. TEST, TEST, TEST within the technique tester earlier than you do anthing on any timeframe and underlying asset as a result of the character of the market may modified quickly.

Discovering the open for Frankfurt and New York:

The EA was developed to commerce indices on the Frankfurt and New York inventory exchanges so you want to inform it when these instances are. As brokers candle shut instances will fluctuate you will have to work this out.

If you’re utilizing the EA to commerce the Frankfurt open that’s at 9am (8am GMT), the New York open is 9:30am (14:30pm GMT). Your brokers candles nonetheless will possible not be these instances. For instance with the dealer PepperStone – / its Server time on MT4 and MT5 is ready to GMT +3 whereas US daylight financial savings is in place, and GMT+2 when the US shouldn’t be beneath daylight financial savings / could have the open in Frankfurt at 10:00 and New York at 16:30.

Technique

The consumer defines the underlying asset and identifies a candle /bar/ on it, with excessive and low values serving as entry factors for a place. The underlying belongings are inventory indices, and the sign candle is set by the time-frame of the asset’s chart to which the Skilled Advisor (EA) is hooked up. For instance, deciding on a chart displaying the DAX index with a 15-minute time-frame means the sign candle is quarter-hour bar, and its finish time is outlined by the consumer because the entry level for this system.

If there’s a breakout of the excessive of sign bar, this system enters an extended place based mostly on predefined buying and selling parameters inside the EA. Conversely, if the low of the sign candle is damaged out, this system enters a brief place. This system allows having each quick and lengthy positions open concurrently. Throughout buying and selling day, this system enters each lengthy and quick positions on the first success of the required circumstances, and just one entry per place is allowed per day.

INPUTS FOR THE EA:

Right here I will element each enter and what influence it has on buying and selling exercise. I’d strongly suggest you place the EA within the visible backtest, play with these settings and see for your self what occurs. It is rather helpful for being worthwhile with this EA to FULLY perceive the logic and the way it trades.

Fundamental Precept for Setting

This system menu is logically divided into the next sections:

- SETTINGS LOTS FOR TRADE

- SELECT TIME FOR SIGNAL BAR

- SELECT LIMIT TIME FOR OPENING TRADES

- SELECT TIME FOR CLOSING OPEN POSITIONS

- CHOOSING TRADING DIRECTION

- SETTING STOP LOSS

- SETTING FIRST PROFIT TAKING

- SETTING SECOND PROFIT TAKING

- STOP LOSS SETTING MOVEMENT

- CONFLUENCES ON LARGE OF SIGNAL BAR

The sections have dropdown menus from which the consumer selects the required technique. Subsequently, based mostly on the chosen technique, the related part parameters are set. Different values within the part, that are irrelevant for the chosen technique, are thought of non-used and develop into related provided that a technique using them is chosen.

MENU

Magic Quantity – This ought to be distinctive for each occasion of the EA so it is aware of which trades to handle. It is going to solely handle trades it has opened with this quantity. If you wish to run a number of variations of the technique on the identical instrument or extra devices, use distinctive magic numbers on every occasion.

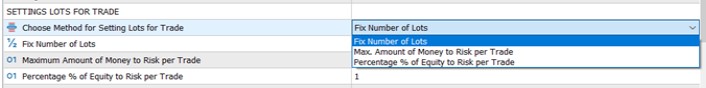

SETTING LOTS FOR TRADE

Select Technique for Setting Tons for Commerce – Person can use three strategies of setting Tons for commerce.

1/ Repair Variety of Tons: Person sorts a repair variety of tons he desires to commerce.

2/ Most Quantity of Cash to Threat per Commerce: Person defines how a lot Cash he desires to threat in a single commerce. This system will calculate what number of tons can be traded.

3/ Share of Fairness to Threat per Commerce : Person defines the proportion of Fairness he desires to threat in a single commerce and this system will calculate the quantity of tons.

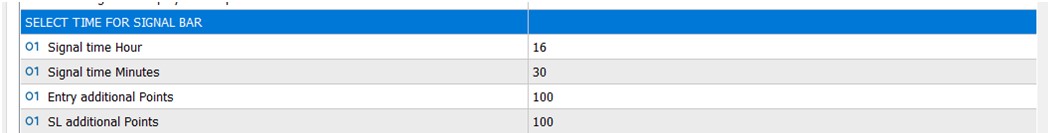

SELECT TIME FOR SIGNAL BAR

Sign Time Hour: The HOUR of Sign bar to be commerce

Sign Time Minutes: The MINUTE of Sign bar to be completed

Entry Further Factors: What number of POINTS to be added to chose Sign BAR for opening the commerce

SL Further Factors: What number of POINTS to be added to chose Sign BAR for establishing the Cease Loss (In case the Cease Loss is outlined as the dimensions of the Sign BAR)

IMPORTANT

The Sign Time Hour and Minutes outline the closing time of the sign bar. For instance, if the EA is hooked up to a chart displaying the DAX asset with a 15-minute time-frame, and the Sign Time Hour is ready to 10, and Sign Time Minutes is ready to 30, the sign bar is a 15-minute candle beginning at 10:15 and shutting at 10:30.

IMPORTANT NOTE ON 2 DIGIT BROKERS WITH INDICES:

Menu examples are based mostly on a single digit dealer (e.g.PepperStone) who quote a value as 16525.5 or 30254.5 and many others…

Some brokers /ICMARKET/ quote 2 digits so these examples above would develop into 16525.50 and 30254.50.

With these 2 digit brokers any inputs regarding pips you want an additional 0 for. So if we set Entry extra level to 100 and having PepperStone, it implies that entry for lengthy place can be excessive of Sign Bar + 10 pips. If we have now ICMARKET, Entry aditional Factors must be 1000.

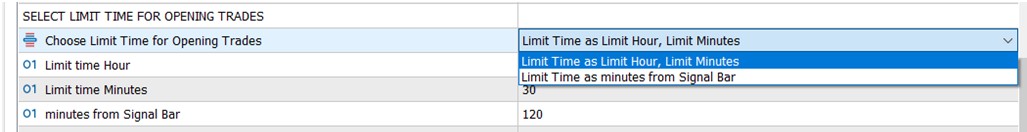

SELECT LIMIT TIME FOR OPENING TRADES

Select Restrict Time for Opening Trades: It permits the consumer to decide on between two strategies for figuring out the entry finish /restrict/ time when the EA can enter a commerce if the circumstances of the breakout technique are met.

1/ Restrict Time as Restrict Hour, Restrict Minutes

Restrict Time Hour: Person units the HOUR

Restrict Time Minutes: Person units the MINUTE

2/ Restrict Time as Minutes from Sign BAR: Person defines the interval of MINUTES throughout which the commerce may be open when the circumstances for the commerce a fullfilled. The MINUTES depend from closing up the chosen BAR for buying and selling.

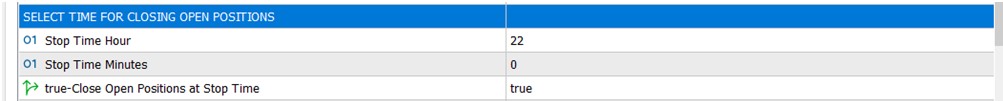

SELECT TIME FOR CLOSING OPEN POSITIONS

Cease Time Hour: Person defines the HOUR of closing the commerce

Cease Time Minutes: Person defines the Minute of closing the commerce

True-Shut Open Positions of Cease Time: TRUE or FALSE

If TRUE – the commerce can be closed at outlined time.

If FALSE – the commerce will proceed

IMPORTANT: TRUE positions allows to shut the open trades irrespective of the buying and selling place is in revenue or in loss. This feature is utilized by merchants to keep away from buying and selling throughout evening, for instance.

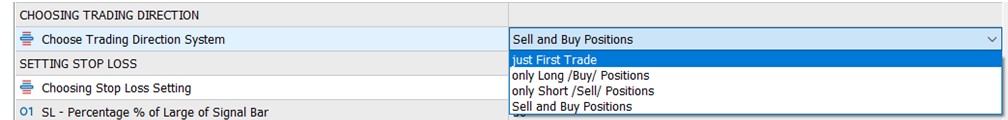

CHOOSING TRADING DIRECTION

Selecting buying and selling Path System: This setting allows the consumer to decide on which kind of commerce shall be open.

1/ Simply First Commerce: opens first commerce solely – whether or not Lengthy or Quick, relies upon which circumstances can be fulfilled sooner.

2 / Solely Lengthy/Purchase Place: opens LONG place provided that the circumstances are fulfilled

3/ Solely Quick/Promote Place: opens SHORT place provided that the circumstances are fulfilled

4/ Promote and Purchase Positions: opens each LONG and SHORT place when the circumstances for commerce are meet.

IMPORTANT: This system opens commerce if the circumstances are fulfilled, most 1 commerce on one place in LONG and SHORT per day. In case the place shouldn’t be closed throughout buying and selling day then it continues into subsequent buying and selling day and EA doesn’t open place in path (LONG or SHORT) of the open place from earlier day.

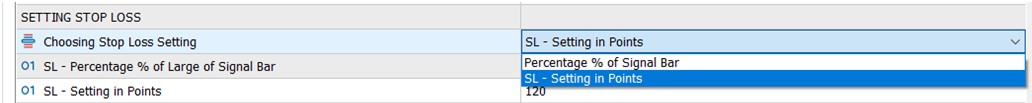

SETTING STOP LOSS

Selecting Cease Loss Setting : Person can select Cease Loss setting from 2 strategies.

1/ Share % of Sign Bar: This feature allows to set the dimensions of Cease Loss calculating out from the dimensions of the traded Sign BAR as its proportion. 100 = full dimension of the BAR, 60 = 60% of dimension of the Sign Bar

2/ SL – Setting in Factors: On this choice consumer defines the Cease Loss in POINTS.

IMPORTANT: If use cease loss setting as % of Sign Bar, the dimensions of Sign Bar = (dimension of Sign Bar+Entry Aditional Factors+Sl Aditional Factors)

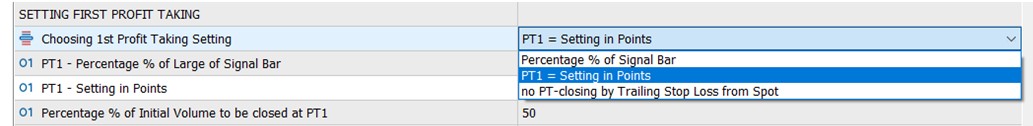

SETTING FIRST PROFIT TAKING

Program allows partial Revenue Taking of commerce at two ranges. This half defines technique for 1st Revenue Taking degree. The amount for closing at revenue taking degree 1 is setting over menu enter – Share of Preliminary Quantity to be closed at PT1.

Selecting 1st Revenue Taking Setting : Person can select setting Revenue Taking Stage 1 over three strategies.

1/ PT1- Share % of Measurement of Sign Bar: This feature allows to set the extent of PT1 calculating out from the dimensions of the traded Sign BAR. 50 = means 50% of dimension of Sign Bar. If dimension of Bar is 30 pips, PT1 can be 15 pips.

2/ PT1 – Setting in Factors: setting in factors

3/ no PT – closing by Trailling Cease Loss from Spot: If this feature is chosen, the place does not have a profit-taking degree, however it closes whole place /all quantity/ on a trailing stop-loss. An preliminary trailing stop-loss of place is activated, that means that with each 1-pip revenue motion, the stop-loss place is adjusted /trailed/. Due to this fact, the place closes if a pullback happens equal to the stop-loss degree of the place.

Share % of Preliminary Quantity to be closed at PT1: – this feature defines what number of % % of quantity of place can be closed in PT1. The remainder of the place can be closed in SETTING SECOND PROFIT TAKING. For instance: If there’s 100. It implies that whole commerce can be closed at PT1. If there’s 60, it implies that 60% of quantity can be closed at PT1 and the remaining /40%/ of commerce can be closed at PT2 setting. This setting is related only for 1st and 2nd strategies for setting PT1.

IMPORTANT: If the a part of the place is closed in PT1 the Cease Loss can be ALWAYS instantly moved to Breakeven (Opening degree) of place . If the Cease Loss has already being moved to raised degree than BE degree in keeping with setting SL in part STOP LOSS SETTING MOVEMENT, the higher degree of SL will stay.

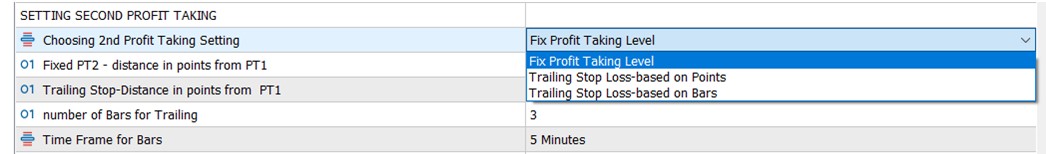

SETTING SECOND PROFIT TAKING

Selecting 2nd Revenue Taking Setting: Person can select setting Revenue Taking Stage 2 over three strategies.

1/ Mounted PT2 – distance in Factors from PT1: Person defines what number of Factors from PT1 – first revenue taking degree in optimistic path – should be achieved to shut the remainder of commerce -relevant setting if Repair Revenue Taking Stage is chosen

2/ Trailling Cease-Distance in factors from PT1: Person defines what number of Factors from PT1 in optimistic DIRECTION should be achieved to begin trailing the Cease Loss from PT1– related setting if Trailing Cease Loss-based on Factors is chosen

3/ if the strategy – Trailling Cease Loss-based on Bars is chosen: Cease Loss can be trailed in keeping with bars outlined in related inputs and can shut the commerce when the bottom (LONG place) or highest (SHORT place) worth of the chosen NUMBER of BARs is achieved.

Variety of Bars for Trailing: Person defines what number of BARs shall be counted.

Time Body for Bars: Person defines the Time Body of the BARs (e.g. 1 min. Bar, 5 min. Bar.,…)

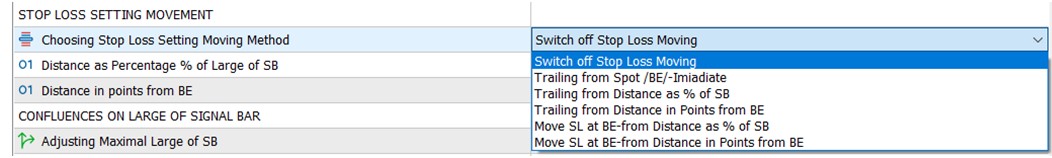

STOP LOSS SETTING MOVEMENT

Selecting Cease Loss Setting Shifting Technique : Person can set an impartial transfer of preliminary Cease Loss place. Chosen transfer of Cease Loss will at all times be terminated /finnished/ when place achieves the extent of PT1. There are 5 prospects for setting this transfer of SL of place.

1/ No Cease Loss Shifting: This feature turns off Cease Loss shifting. Cease Loss can be moved to Breakeven if the extent of PT1 can be achieved, solely.

2/ Trailing from Spot/BE/ Instant: Trailing begins instantly. Cease Loss can be moved with each transfer of the commerce in proper path.

3/ Trailing from Distance as % of SB (Sign Bar): Cease Loss trailing will begin when the place achieves the extent of BE plus distance in commerce path outlined as a proportion % of the dimensions of Sign Bar. Related enter for this technique is Distance as Share of Measurement of SB.

4/ Trailing from Distance in Factors from BE (Breakeven): Cease Loss trailing will begin when the place achieves the extent of BE plus distance in commerce path outlined in Factors. Related enter for this technique is Distance in Factors from BE.

5/ Transfer SL at BE-from Distance as % of SB (Sign Bar): Cease Loss place will transfer one time solely (=no trailing) if the place achieves the extent of BE plus distance in commerce path outlined as a proportion % of the dimensions of Sign Bar. Related enter for this technique is Distance as Share of Measurement of SB

6/ Transfer SL at BE- from Distance in Factors from BE (Breakeven): Cease Loss place will transfer one time solely (=no trailing) if the place achieves the extent of BE plus distance in commerce path outlined in Factors. Related enter for this technique is Distance in Factors from BE.

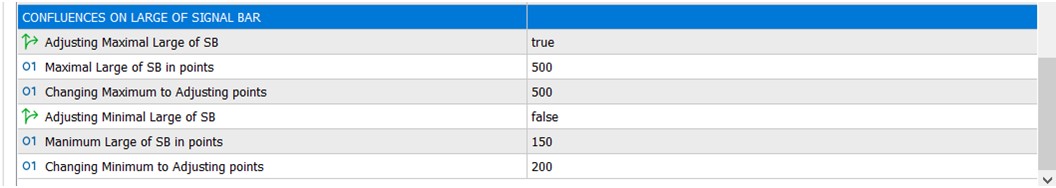

CONFLUENCES OF LARGE OF SIGNAL BAR

Person can regulate the dimensions of the Sign Bar in keeping with his/her preferences.

Adjusting Maximal Measurement of SB

FALSE: this operate is switched off

TRUE: this operate is switched on

Minimal Measurement of SB in Factors: defines the worth of Sign Bar dimension to be exceeded and recalculated to the dimensions outlined in Changing Most to Adjusting Factors

Altering Most to Adjusting Factors: Person adjusts the dimensions of Sign Ba

Instance: Person defines the maximal dimension of Sign Bar to 50 pips (dealer calculates 1 decimal place, the worth can be 500). Altering Most to Adjusting Factors consumer defines to 40 pips (dealer worth 400). It means if the dimensions of Sign Bar is =>50 pips the dimensions of the Sign Bar can be adjusted to 40 pips, solely. From this worth (40 pips) the menu settings regarding cease loss, revenue taking can be calculated if strategies chosen by consumer relies on dimension of sign bar and never factors.

Adjusting Minimal Measurement of SB

FALSE: this operate is switched off

TRUE: the operate is switched on

Minimal Measurement of SB in Factors: defines the worth of Sign Bar dimension to not be exceeded and recalculated to the dimensions outlined in Changing Minimal to Adjusting Factors

Altering Minimal to Adjusting Factors: Person adjusts the dimensions of Sign Bar

Instance: Person defines the minimal dimension of Sign Bar to twenty pips (dealer calculates 1 decimal place, the worth can be 200). Altering Minimal to Adjusting Factors consumer defines to 30 pips (dealer worth 300). It means if the dimensions of Sign Bar <=20 pips the dimensions of the Sign Bar can be adjusted to 30 pips. From this worth (30 pips) the menu settings regarding cease loss, revenue taking can be calculated if technique chosen by consumer relies on dimension of sign bar and never factors

[ad_2]

Supply hyperlink