In a month marked by heightened volatility, Apecoin (APE) has been a battleground for bulls striving to forestall a dip under the essential $1 mark.

This tug-of-war between bulls and potential downward strain underscores the extreme market dynamics surrounding Apecoin, leaving buyers on the sting as they monitor the crypto’s value actions on this risky November panorama.

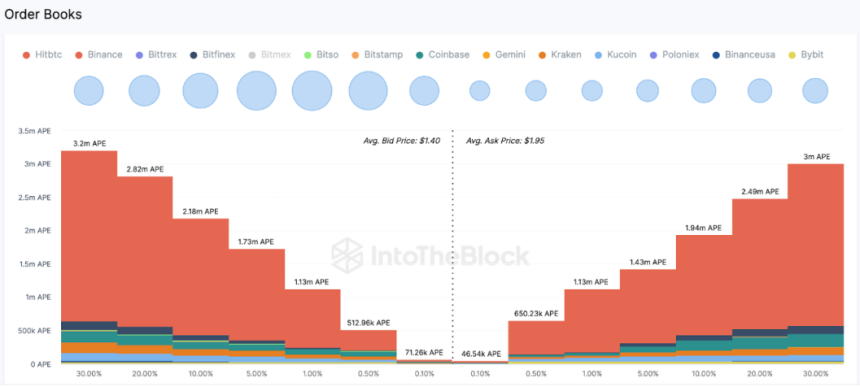

The newest information from the spot market reveals a resolute stance from bullish merchants, as orders for greater than 11 million APE tokens have beern strategically positioned across the present value.

APE has elevated by 30% to surpass $1.70 following a decline to a weekly low of $1.30 on November 21. On-chain information tasks long-term Apecoin buyers’ resilience would possibly reenergize APE value prospects.

APE Complete Order Books. Supply: IntoTheBlock

Apecoin Worth Rebounds From All-Time Low

On October 9, the value of Apecoin plunged to an all-time low and narrowly averted breaking under the $1 help stage. Nevertheless, the APE token has now elevated by 40%, and as of November 24, the meme coin was buying and selling at about $1.45.

The market scenario that APE is now working in is tough. The current value will increase of the token are in danger because of bearish on-chain indicators.

Over the previous couple of months, the quantity of APE cash obtainable on exchanges has nearly doubled to just a little over 50 million, which can sign a rise in purchaser demand.

The mixture of a lower in lively addresses and a rise in provide on exchanges signifies a pessimistic deviation, which can point out an impending decline within the value of the meme foreign money.

Two notable corrections have occurred in APE throughout its present surge. The 61.8% Fibonacci stage marked the primary retracement, and 50% marked the second corrective.

Complete crypto market cap is presently at $1.4 trillion. Chart: TradingView.com

These retracements are getting thinner, which is a bullish indication of accelerating momentum and extra purchaser conviction.

Taking this into consideration, buyers could use the 38.2% and 50% Fibonacci ranges as a useful information when inserting stop-loss orders, appearing as a buffer towards any market volatility.

Apecoin’s value is now bouncing between $1.063 and $1.506, indicating that it’s in a risky market. There are some indications of stability from the 10-Days Shifting Common at $1.410 and the 100-Days Shifting Common at $1.303.

Nonetheless, it’s essential to regulate the resistance ranges at $1.695 and $2.139 and the help ranges at $0.365 and $0.808. These ranges will probably be essential in influencing the short-term value actions of APE.

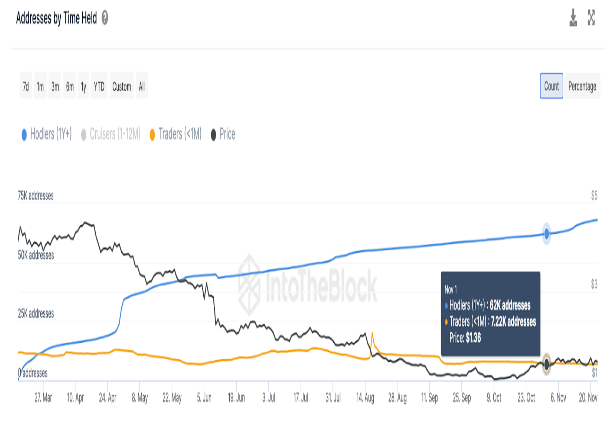

APE addresses by time held. Supply: IntoTheBlock

Shift In Deal with Dynamics

In the meantime, as reported by IntoTheBlock, a constructive pattern divergence is clear between the long-term and short-term holder addresses for APE. Illustrated within the Addresses by Time Held chart, the rely of long-term addresses has surged by 6,060 wallets because the starting of November.

Concurrently, the Apecoin community has skilled a lower of three,800 within the variety of dealer/short-term wallets over the identical interval, highlighting a noteworthy shift in deal with dynamics.

The forthcoming week holds important significance for buyers in APE, as it can function a vital evaluation of the sturdiness of this meme coin and its prospects for extra upward actions.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Pexels