[ad_1]

Avalanche, the fourth-generation proof-of-stake (PoS) blockchain, incurs vital prices to incentivize its validators. Token Terminal knowledge on December 7 exhibits that previously yr, the sensible contract platform paid over $275 million in AVAX to compensate its validators regardless of producing solely $11.5 million in consumer charges.

Avalanche Is Paying A Premium To Incentivize Validators

Though it seems that Avalanche is paying a premium for validators, that is crucial in securing the community and guaranteeing all transactions are confirmed. Total, and being a proof-of-stake community reliant on node operators for safety and decentralization, Avalanche’s resolution to pay validators a premium is, as its customers demand, to take care of a strong community of nodes.

In accordance with CoinMarketCap knowledge, the community has a market cap of over $9.8 billion. It’s at the moment within the high 10 by liquidity, surpassing Polygon and Polkadot, competing low-fee alternate options. As it’s, by incentivizing validators with beneficiant rewards, Avalanche ensures that there’s a sturdy pool of nodes accessible to take care of the community’s operation.

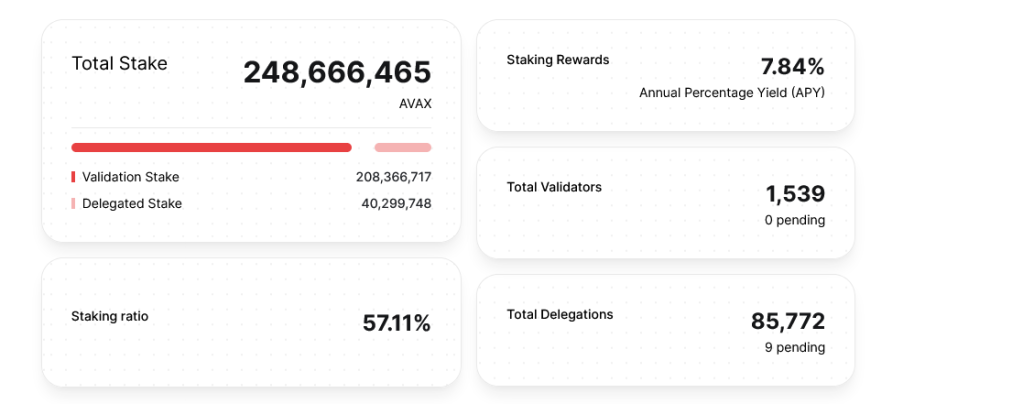

By these validators, AVAX holders can stake and obtain rewards. As of December 7, there are over 1,539 validators at the moment staking over 248 million AVAX and incomes 7.84% APY. On the similar time, statistics present that Avalanche has a staking ratio of 57.11%. Most AVAX in circulation are used to safe the community at this stage.

Whereas AVAX incentivization may draw extra validators, Avalanche documentation additionally states that the community doesn’t require advanced {hardware} to function a node. On the similar time, the blockchain, not like Ethereum, states that staked AVAX is just not prone to being slashed–or penalized by the community–offered all community necessities are met. This function may clarify the regular rise in validator rely over the previous three years.

AVAX Is Up By 200%, Buying and selling At 2023 Excessive

Whereas Avalanche grows its validator rely, AVAX costs have additionally been increasing steadily, mirroring the final market. To this point, AVAX is altering palms above $26, up over 200% within the final three months. At spot charges, AVAX is buying and selling at new 2023 highs and in a bullish breakout formation, worth motion within the day by day chart.

Associated Studying: Apollo Crypto Predicts Bitcoin Value Of $200,000 This Cycle, Right here’s Why

how AVAX is, bulls may break above $30. If the accompanying surge is with increasing buying and selling quantity, it is perhaps the bottom for one more leg up that may carry the coin towards $90 or greater within the classes forward. When AVAX peaked in 2021, it rose to as excessive as $145.

Function picture from Canva, chart from TradingView

[ad_2]

Supply hyperlink