[ad_1]

This yr may very well be a blessing in disguise for gold. The dear steel hit a brand new excessive within the second half of this yr, final closing at $2071 per ounce (simply $8 shy of the ATH). Since gaining help from the lows in February, spot gold has appreciated by practically 15%. One of many major causes for the bullish transfer is the current cooling of US inflation and employment, which has dampened market expectations for the Fed to lift rates of interest within the brief time period.

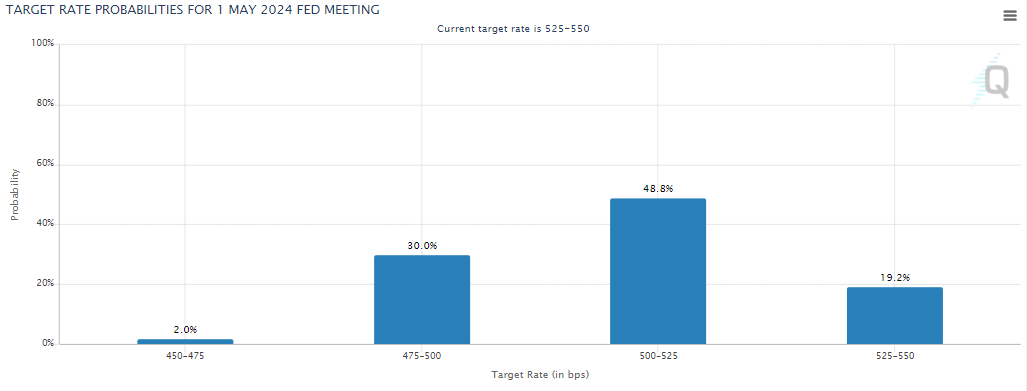

Additionally, in response to CME Fedwatch, the likelihood for the Fed’s first price minimize in Might 2024 elevated to 48.8% (was 35% a month in the past) – one other optimistic catalyst for the yellow steel and its producer Barrick Gold?

Barrick Gold is a Canada-based firm based in 1983 which actively engages within the manufacturing and gross sales of gold and copper, exploration actions and mine growth. It has 16 working websites in 13 international locations, and owns 5 of the ten largest gold mines on the planet.

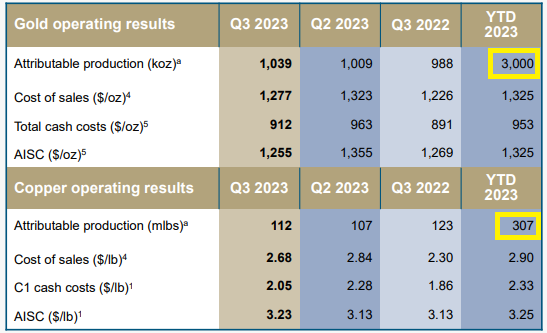

Working Outcomes. Supply: Barrick Gold Outcomes Presentation

Final yr, the corporate produced 4.1 million ounces of gold and 440 million kilos of copper, respectively. In 2023, YTD manufacturing for gold and copper hit 3.0 million ounces and 307 million kilos, nonetheless under the low finish vary of the administration’s steering (4.2 million ounces, 420 million kilos). Nonetheless, taking the typical attributable manufacturing of the corporate and the current tailwinds into consideration, the purpose may very well be inside attain.

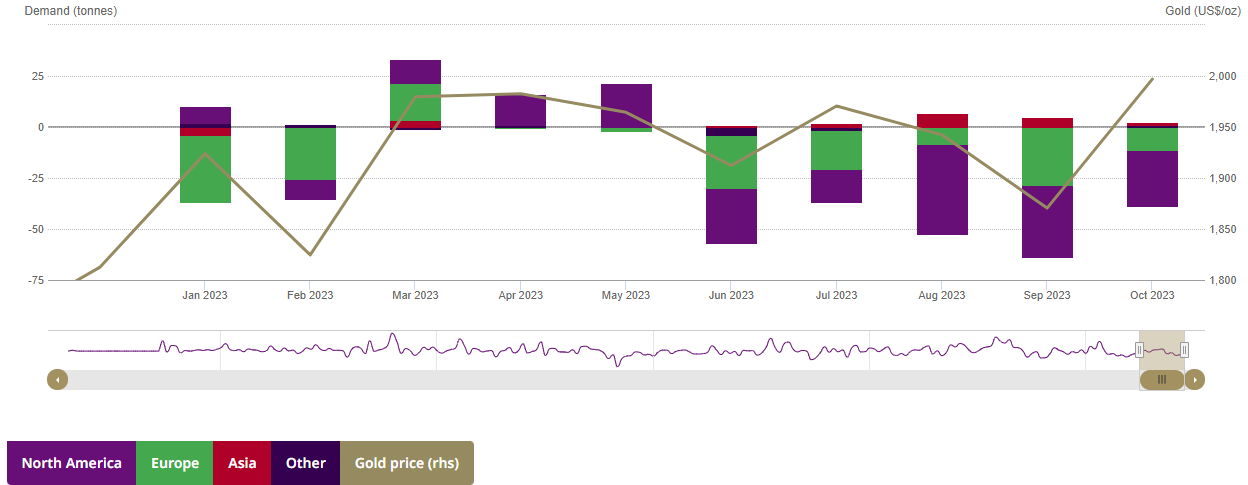

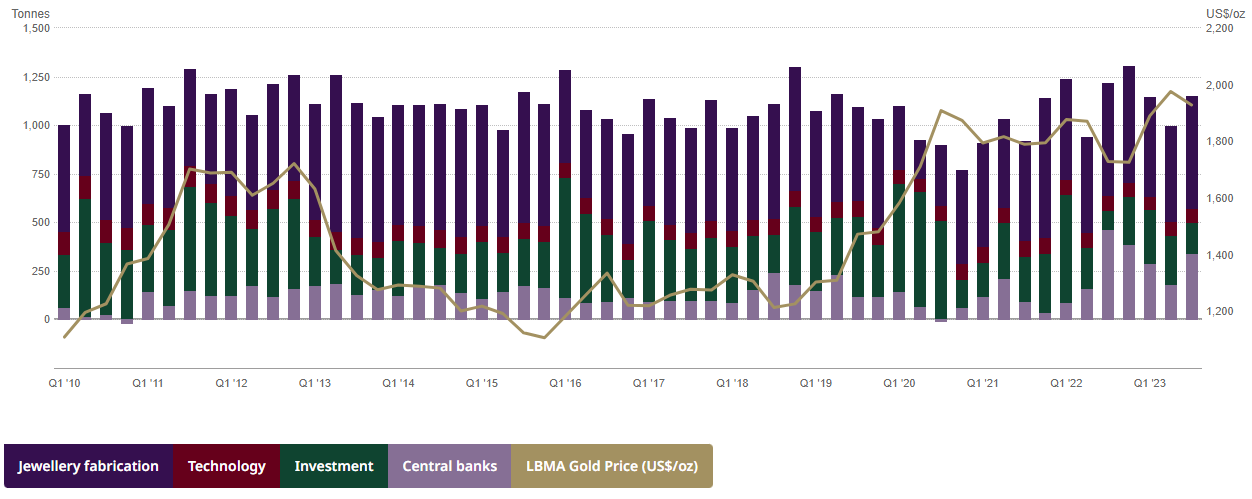

World gold ETF outflows continued for the fifth consecutive month, however at a slower tempo. YTD holdings diminished by 37t to 3245t, however complete AUM managed to enhance by 6% to $209B, backed by a 7% rise within the gold value in October. The worth surge was primarily pushed by geopolitical uncertainties.

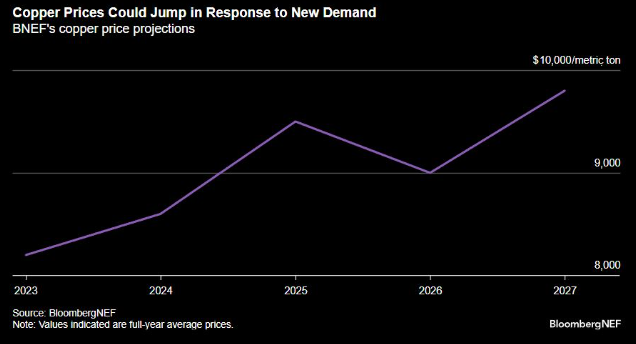

Alternatively, copper value is seen traded inside a spread YTD, between $3.70 and $4.35, following uncertainty surrounding demand, China’s less-than-satisfactory financial restoration and the dim financial outlook within the US. Nonetheless, the first provide deficit outlook for the following few years, in addition to elevated expectations for alleviating of the tightening cycle within the close to future, could function optimistic catalysts to drive the copper value greater.

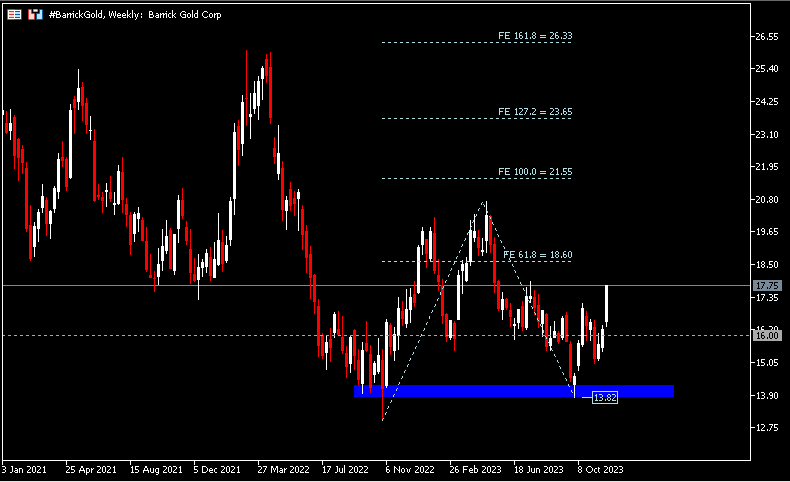

Technical Evaluation:

#BarrickGold discovered help at $13.82 in early October earlier than rising greater and final closed at $17.75, with $16 now serving as the closest help. Primarily based on projection by Fibonacci Enlargement, nearest resistance is seen at $18.60. Breaking above this stage could encourage the asset to proceed difficult $20.74, the best level YTD, earlier than difficult the following resistance at $21.55.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Supply hyperlink