[ad_1]

A Binance critic, “Whale Wire,” on X, who additionally claims to be a crypto whale, has issued a daring prediction that BNB, the native foreign money of the BNB Chain and which is used to incentivize buying and selling exercise on Binance, might plunge 95% to underneath $5 within the coming months.

Relating to Binance agreeing to pay $4 billion in fines associated to authorized settlements with U.S. regulators, Whale Wire argued that tighter oversight will supposedly “destroy Binance’s complete enterprise mannequin.” He additional contended chapter might be imminent as the consequences of the BNB result in a contagion.

Will The BNB Worth Flash Crash?

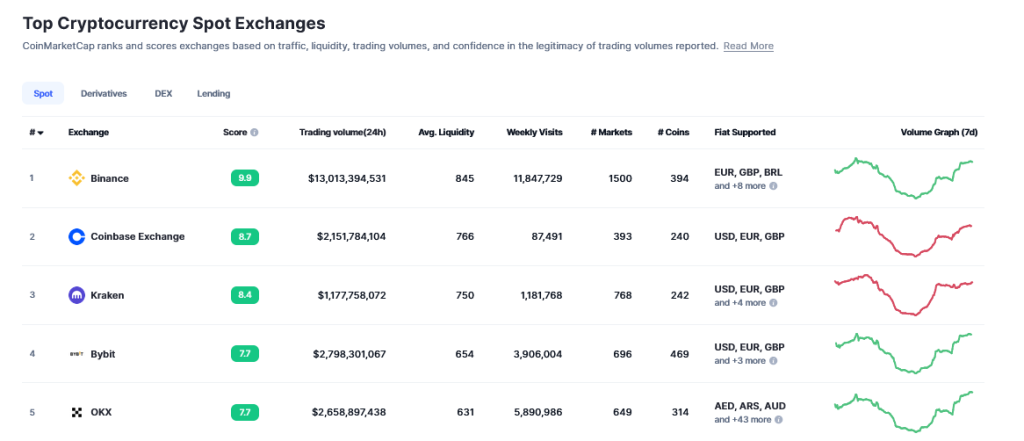

Nevertheless, whereas rising regulatory oversight, wind-downs, and decreased threat tolerance amongst merchants have impacted volumes, Binance stays the world’s largest crypto change by consumer rely and nonetheless facilitates probably the most buying and selling globally by a large margin as of writing on November 22.

For context and pulling information from CoinMarketCap (CMC), Binance continues to dominate spot crypto buying and selling, producing over $14.7 billion in common buying and selling quantity, over 6X Coinbase, with $2.3 billion, and forward by enormous margins from Kraken, which pulls 41.2 billion. The identical development could be noticed in derivatives buying and selling, the place Binance leads forward of OKX.

BNB additionally stays firmly among the many high 5 cryptos out there cap. Moreover USDT, BNB is the third largest coin by market cap, main different altcoins, together with XRP, Solana (SOL), and Cardano (ADA).

Moreover its dominance, Binance has been given over a yr to pay assessed fines. In the meantime, its new CEO, Richard Teng, stated the change will proceed to enact compliance overhauls. On the identical time, it’s assuring purchasers that funds stay secure.

Contemplating the change will proceed working each in the US and globally, the transitional window supplied by the DOJ might make its collapse, and that of BNB, unlikely.

Binance Underneath Stress, Buying and selling Quantity Falling

Even so, factoring in dropping buying and selling quantity in 2023 and the impression of shedding customers, particularly in areas Binance pulled out from, the ensuing dip in income might, on the finish of the day, apply downward pressures on BNB. To this point, Binance bought its enterprise in Russia whereas exiting Canada and the Netherlands.

Presently, $200 stays a essential help degree for BNB. Whether or not this line will probably be retested within the months forward stays to be seen. Altering palms at round $230, BNB is technically in an uptrend within the shorter timeframe. It’s up 15% from October 2023 lows. Nevertheless, it’s nonetheless down 65% from 2021 peaks when it soared to round $670.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Supply hyperlink