[ad_1]

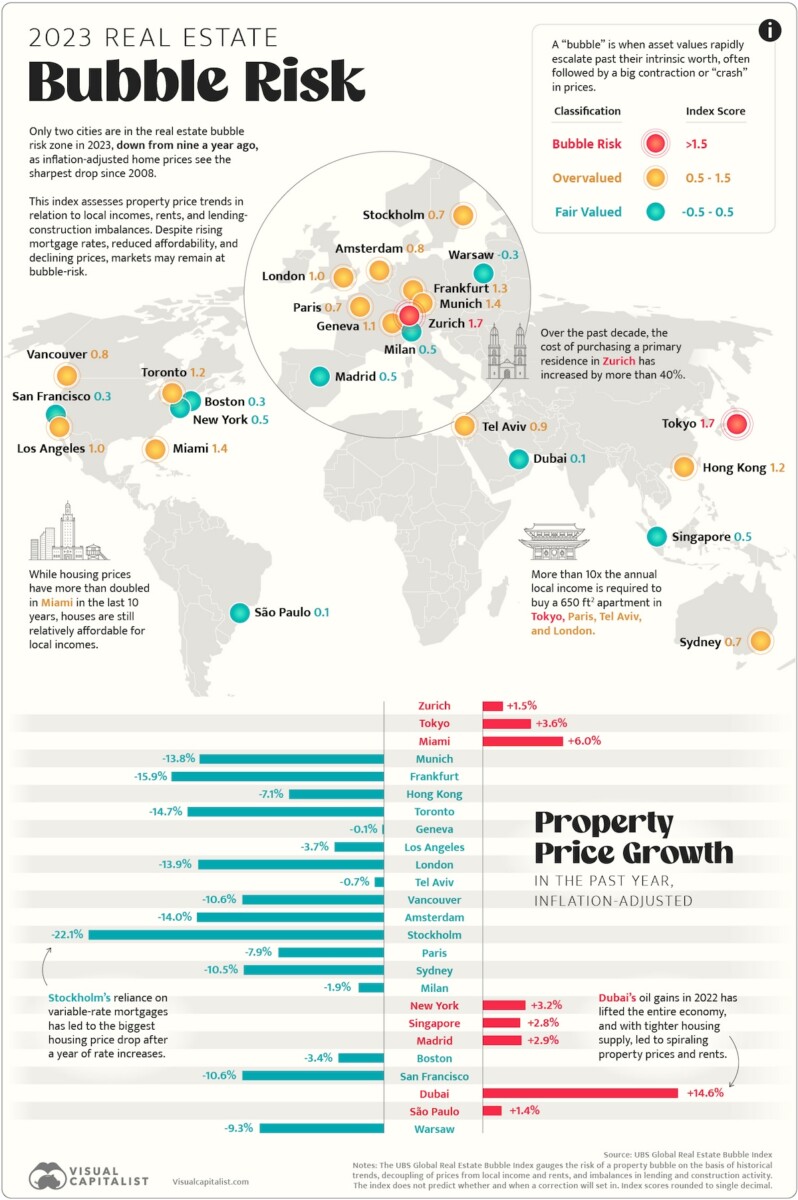

Buoyed by low rates of interest for the final decade, many property markets have seen substantial worth progress since 2010. Consultants warned that actual property bubbles—during which the value of property moved up far past their intrinsic worth—have been forming.

The UBS International Actual Property Bubble Index analyzes the true property market of 25 main cities throughout the globe and assigns them a rating between -0.5 to 2.0 to convey bubble threat. The upper the rating, the extra imbalanced the market is, with these above 1.5 in “bubble-risk” territory.

We visualize the information within the above map, together with charting the true property worth modifications within the final 12 months.

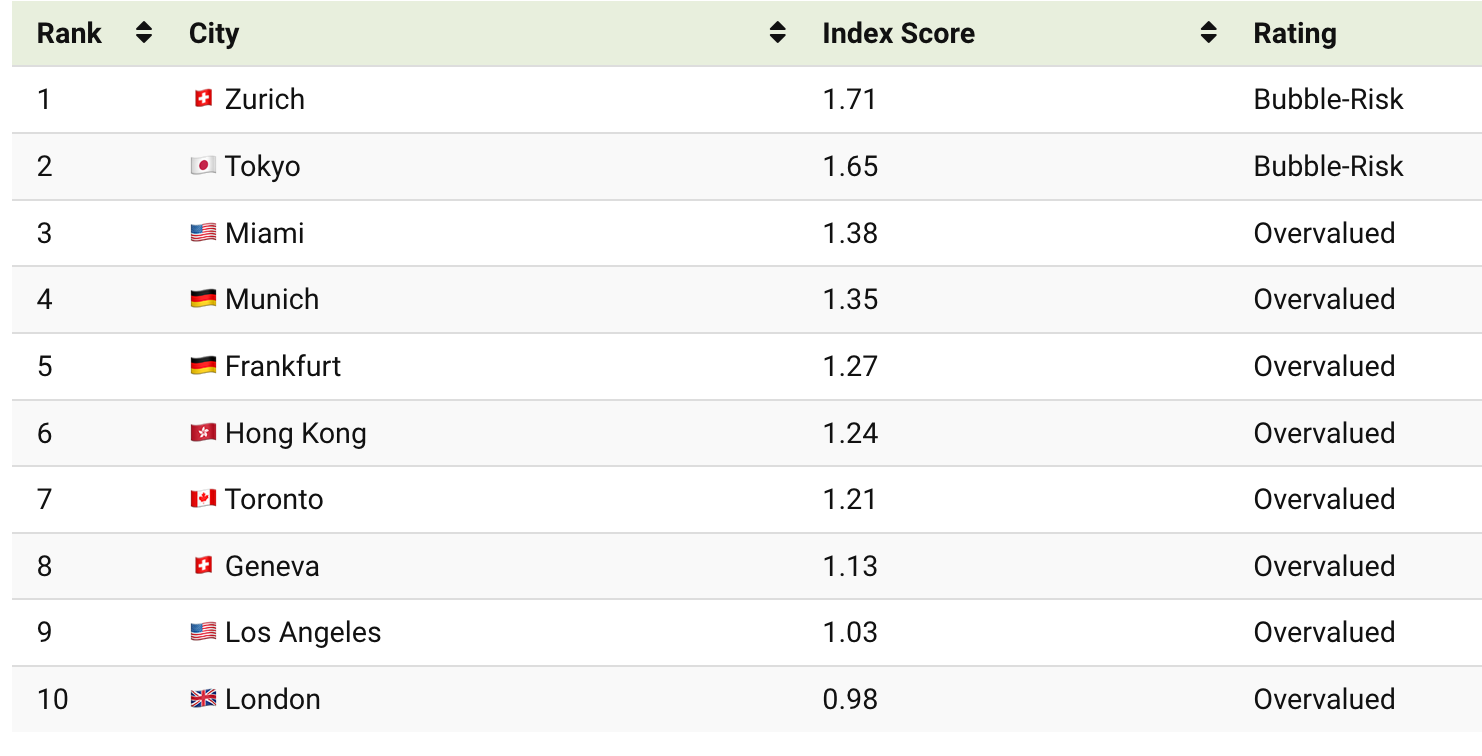

Rating Bubble Threat by Metropolis

On the prime of UBS’ findings is Switzerland’s monetary capital Zurich, with a 1.71 rating, placing the town firmly within the bubble-risk zone. With its high-income earners and the nation’s low rates of interest, the town has been steadily climbing the true property bubble-risk rankings, fifth in 2021, to third in 2022, to the highest spot this 12 months.

In contrast to a lot of its former friends within the dangerous territory, native costs tailored to elevated mortgage charges this 12 months, and have stayed elevated.

Right here’s the total rankings for bubble threat in all 25 property markets:

Zurich, Tokyo & Miami Lead the Bubbilicious Cities

[ad_2]

Supply hyperlink