[ad_1]

Announcement: If you happen to haven’t seen it but, the most recent Singapore Financial savings Bonds yield 3.4% over 10 years, which is the best yielding SSBs for all of 2023 until date!

That is additionally one of many highest since SSBs had been launched, with just a few exceptions resembling final 12 months’s December 2022 tranche, which yielded a barely greater return of three.47% within the unsure rate of interest local weather again then.

At this price, SSBs are actually extra enticing than different short-term risk-free choices resembling banks’ fastened deposits or MAS Treasury Payments. The issue with these 2 different devices is that they’ve a shorter time period length, which implies you must hold discovering new locations to place your funds in after 6 months / 1 12 months / 2 years. For these of you who don’t have any time to maintain purchasing round for various choices, then this month’s SSB may simply be your reply.

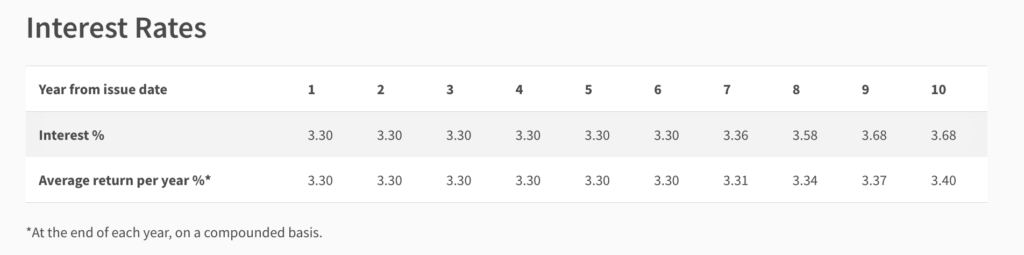

Right here’s the rates of interest for this month’s SSB over the subsequent 10 years:

What I like concerning the Singapore Financial savings Bonds

The large profit with SSBs is that you lock in rates of interest for 10 years. If rates of interest are going to get slashed in 2024, this provides you the choice of holding onto the next yield through this month’s SSB.

Yields apart, the subsequent smartest thing about SSBs are in its liquidity since you solely want to attend for 1 month to liquidate your funds. At any time if you want the money again, you will get it inside the begin of the next month.

The minimal sum can be pretty low, beginning at simply $500 and in multiples of $500. The utmost quantity of SSBs you possibly can maintain at anybody time (together with from earlier months’ tranches) are capped at $200,000.

SSBs are additionally backed by the Singapore authorities, making it a fairly risk-free alternative for these of you who’re tremendous risk-adverse. There could also be different greater yield choices in immediately’s market, however do observe that these aren’t risk-free:

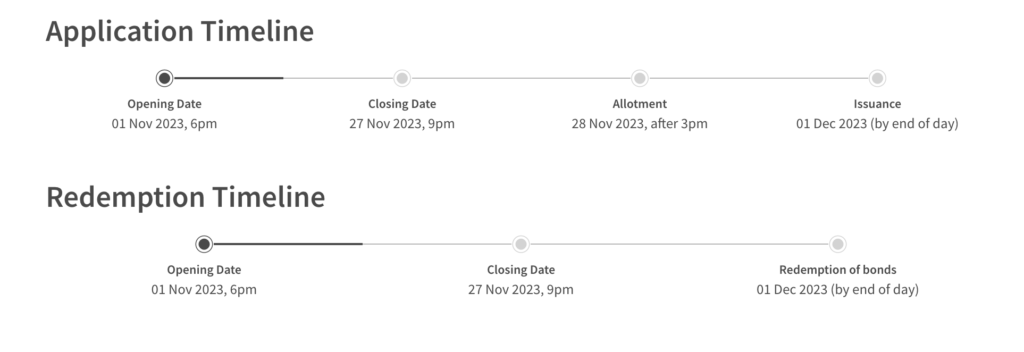

The appliance timeline could be discovered beneath, or right here at the official SSB hyperlink:

If you happen to’re intending to use, you are able to do so by means of your DBS/POSB, OCBC or UOB web banking portals or ATMs. And if you happen to intend to make use of your Supplementary Retirement Scheme (SRS) funds as an alternative, then you definately’ll have to make use of the net banking portal of the financial institution the place you’ve gotten your SRS funds deposited in.

The one value is the $2 utility price and some minutes to get it arrange through web banking.

Word: You can not use your CPF funds to purchase SSBs.

Share this with anybody you already know who may need to take a look at this month’s bond.

For extra particulars, chances are you’ll cross-verify on the official SSB web site by MAS right here.

[ad_2]

Supply hyperlink