[ad_1]

A reader asks:

Positive it’s nice the S&P 500 is up 20% this 12 months however aren’t we simply pricing within the inevitable Fed fee cuts in 2024? Ought to we actually anticipate the market to go up once more subsequent 12 months after stunning to the upside this 12 months? Colour me skeptical. Full disclosure: I’m naturally bearish and take a little bit of an anti-Ben stance in regards to the markets.

See that is what makes a market!

It’s truthful for anti-Ben to ask if the present run-up within the inventory market is pricing in fee cuts for subsequent 12 months. The inventory market is ahead taking care of all.

I really like learning historic market returns. market historical past isn’t going that will help you predict the longer term however it may provide help to higher perceive the way in which the inventory market typically features.

As an example, taking a look at annual returns within the inventory market received’t let you know what occurs subsequent 12 months however it may provide help to put together for a spread of outcomes to set one thing of a baseline.

One in all my all-time favourite market stats is the truth that the U.S. inventory market has extra 20% up years than unfavorable years for the reason that Twenties. It’s true.

Since 1928, there have been 34 calendar years1 the place the S&P 500 has completed up 20% or extra in opposition to 26 complete down years.2

This implies the inventory market has been up 20% or extra 36% of the time and down 27% of all years. That’s a reasonably good trade-off, particularly when you think about the common down 12 months is a lack of ~13%.

The query anti-Ben appears to be asking right here is: What occurs after a 20% achieve?

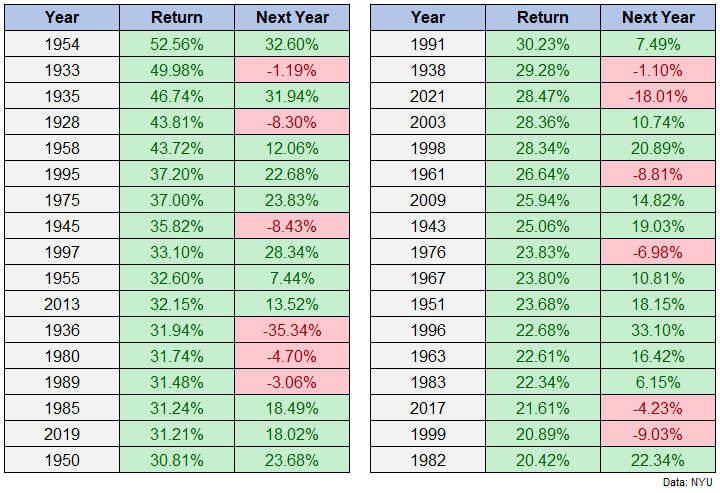

Listed here are all the 20% up years together with the next 12 months returns:

Not too dangerous. Extra inexperienced than purple for positive. Listed here are the abstract statistics:

- The inventory market was up 22 out of the 34 years following a 20% achieve (65% of the time).

- The inventory market was down 12 out of the 34 years following a 20% achieve (35% of the time).

- The typical return following a 20% up 12 months was 8.9%.

- The typical achieve was +18.8% in up years.

- The typical loss was -9.1% in down years.

- There have been 19 double-digit up years.

- There have been simply two double-digit down years (1936 and 2022).

This 12 months is teetering on the sting of one other 20% up 12 months. We’ll see if Santa comes by means of for us by the tip of the 12 months or not however thus far so good.

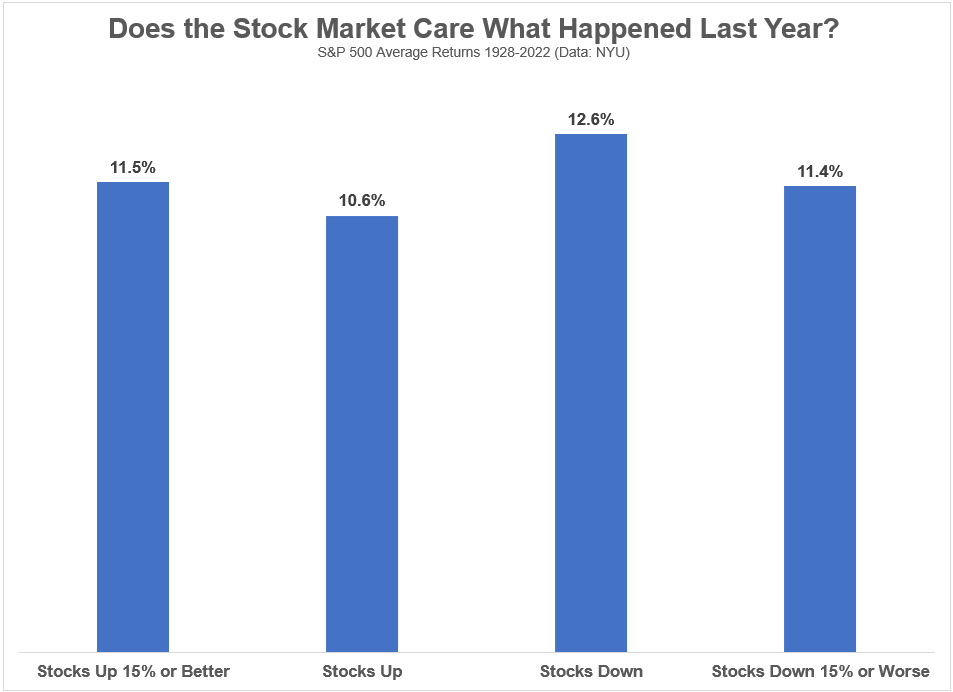

It’s additionally essential to ask how a lot returns in a single 12 months truly influence returns within the following 12 months. Right here’s a have a look at common returns following a giant up 12 months, an up 12 months, a down 12 months and a giant down 12 months:

So possibly the 20% place to begin issues lower than one would assume.

I’m positive you may slice and cube the information to supply up some extra sign however there doesn’t seem like a lot correlation from one 12 months to the following.

More often than not shares go up however typically they go down is about pretty much as good as you’re going to get.

It’s actually doable the inventory market has been pricing in Fed fee cuts for early subsequent 12 months. The S&P 500 isn’t going to attend round for Jerome Powell to spell it out. The inflation fee is falling, rates of interest are falling, and wage progress is falling so it is sensible for the Fed to start out chopping someday within the first half of 2024.

However I can’t fake to be good sufficient to know the way a lot of that’s priced into the inventory market or what comes subsequent.

Historic return numbers may also help set expectations but it surely’s additionally true that issues occur within the markets on a regular basis which have by no means occurred earlier than.

I don’t know if we’re establishing for a brand new bull market or a flat market or a brand new bear market.

Profitable traders perceive it’s unattainable to foretell the kind of market surroundings that’s coming. The very best factor you are able to do is put together for a variety of outcomes to keep away from permitting short-term actions out there to have an effect on your conduct.

We tackled this query on the newest Ask the Compound:

Tax professional Invoice Candy joined me as soon as once more to reply questions on bond fund yields, promoting down giant single inventory positions, direct indexing, and when to pay your mortgage off early.

Additional Studying:

What Returns Ought to You Anticipate within the Inventory Market?

1Not together with 2023…but.

2There have been simply six down years of 20% or worse losses.

[ad_2]

Supply hyperlink